A) In all of the states, according to the apportionment formulas of each, as the U.S. government is present in all states.

B) $100,000 in A.

C) $100,000 in B.

D) $0 in both A and B.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Usually a business chooses a location where it will build a new plant based chiefly on tax considerations.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

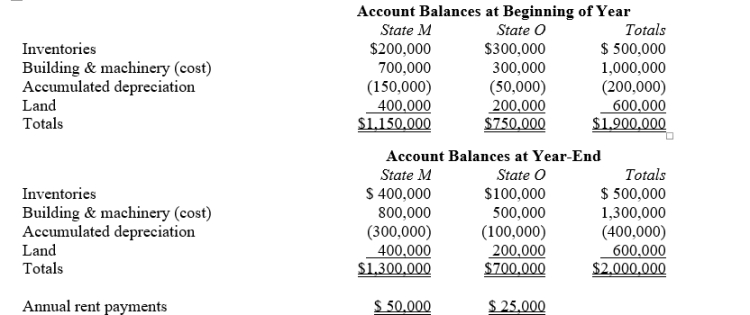

Bert Corporation, a calendar-year taxpayer, owns property in States M and O. Both M and O require that the average value of assets be included in the property factor. M requires that the property be valued at its historical cost, and O requires that the property be included in the property factor at its net depreciated book value.  Bert's State M property factor is:

Bert's State M property factor is:

A) 75.0%.

B) 66.7%.

C) 64.9%.

D) 64.5%.

F) None of the above

Correct Answer

verified

C

Correct Answer

verified

True/False

Politicians frequently use tax credits and exemptions to create economic development incentives.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In determining a corporation's taxable income for state income tax purposes, which of the following does not constitute a subtraction from Federal income?

A) Interest on U.S. obligations.

B) Expenses that are directly or indirectly related to state and municipal interest that is taxable for state purposes.

C) Federal corporate income taxes paid.

D) The amount by which the Federal depreciation deduction exceeds the corresponding state amount.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The benefits of a passive investment company typically include:

A) Reduced state income taxes.

B) Isolation of the entity's portfolio income from taxation in other nonunitary states.

C) Exclusion of the subsidiary's portfolio income from the parent corporation's apportionment formula denominator in other nonunitary states.

D) All of the above are benefits.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A state sales tax usually falls upon:

A) Sales of groceries.

B) Sales of widgets made to out-of-state customers.

C) Sales of widgets made to the ultimate consumer of the product or service.

D) Sales of real estate.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

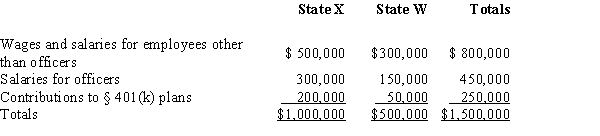

Net Corporation's sales office and manufacturing plant are located in State X. Net also maintains a manufacturing plant and sales office in State W. For purposes of apportionment, X defines payroll as all compensation paid to employees, including contributions to § 401(k) deferred compensation plans. Under the statutes of W, neither compensation paid to officers nor contributions to § 401(k) plans are included in the payroll factor. Net incurred the following personnel costs.  Net's payroll factor for State W is:

Net's payroll factor for State W is:

A) 50.00%.

B) 37.50%.

C) 33.33%.

D) 0.00%.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following items with the appropriate description, in determining whether sales/use tax typically must be collected a.Taxable b.Not taxable -Prescription drugs and medicines purchased by a consumer.

A) Taxable

B) Not taxable

D) undefined

Correct Answer

verified

Correct Answer

verified

Multiple Choice

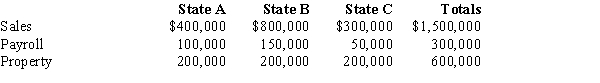

Cruz Corporation owns manufacturing facilities in States A, B, and C. A uses a three-factor apportionment formula under which the sales, property and payroll factors are equally weighted. B uses a three-factor apportionment formula under which sales are double-weighted. C employs a single-factor apportionment factor, based solely on sales.

Cruz's operations generated $1,000,000 of apportionable income, and its sales and payroll activity and average property owned in each of the three states is as follows.

Cruz's apportionable income assigned to C is:

Cruz's apportionable income assigned to C is:

A) $1,000,000.

B) $273,333.

C) $200,000.

D) $0.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following terms with the appropriate description, in the state income tax formula. Apply the UDITPA rules in your responses -Treasury Bond interest income.

A) Addition modification

B) Subtraction modification

C) No modification

E) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following terms with the appropriate description, in the state income tax formula. Apply the UDITPA rules in your responses -State-level NOL.

A) Addition modification

B) Subtraction modification

C) No modification

E) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

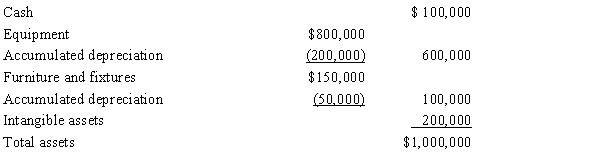

Guilford Corporation is subject to franchise tax in State Z. The tax is imposed at a rate of 2.5% of the taxpayer's net worth that is apportioned to the state by use of a two factor (sales and property equally weighted) formula. The property factor includes real and tangible personal property, valued at net book value at the end of the taxable year.

Sixty percent of Guilford's sales are attributable to Z, and $200,000 of the net book value of Guilford's tangible personal property is located in Z.

Determine the Z franchise tax payable by Guilford this year, given the following end-of-the year balance sheet.

A) $0, due to the negative retained earnings

B) $6,050

C) $8,250

D) $13,750

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

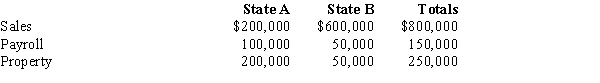

Boot Corporation is subject to income tax in States A and B. Boot's operations generated $200,000 of apportionable income, and its sales and payroll activity and average property owned in each of the states is as follows.

How much more (less) of Boot's income is subject to A income tax if, instead of using an equally-weighted three-factor apportionment formula, A uses a formula with a double-weighted sales factor?

How much more (less) of Boot's income is subject to A income tax if, instead of using an equally-weighted three-factor apportionment formula, A uses a formula with a double-weighted sales factor?

A) ($50,000)

B) $50,000

C) $16,100

D) ($16,100)

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Typically exempt from the sales/use tax base is the purchase by a symphony orchestra of printed music for its players.

B) False

Correct Answer

verified

True

Correct Answer

verified

True/False

Sales/use tax nexus is established for the taxpayer by the sales-solicitation activities of an independent contractor acting on the taxpayer's behalf.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the taxpayer has exposure to a capital stock tax:

A) The pricing of inventory sales should reflect no more than inflation increases.

B) Subsidiary operations should be funded through direct capital contributions.

C) Dividends should be paid regularly to a parent based in a low-tax state.

D) Expansions should be funded with retained earnings.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Roughly five percent of all taxes paid by businesses in the U.S. are to state, local, and municipal jurisdictions.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A typical state taxable income addition modification is for the Federal income tax paid for the tax year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following items with the appropriate description, in applying the P.L. 86-272 definition of solicitation -Purchasing ads that show up on search-result screens for internet browsers.

A) More than solicitation, creates nexus

B) Solicitation only, no nexus created

D) undefined

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 123

Related Exams