A) Journal entries

B) Adjusting journal entries

C) Closing journal entries

E) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net income appears on the end-of-period spreadsheet in the

A) debit column of the Balance Sheet columns

B) debit column of the Adjustments columns

C) debit column of the Income Statement columns

D) credit column of the Income Statement columns

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

All companies must use a calendar year as their fiscal year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Liabilities that will be due within one year or less and that are to be paid out of current assets are called current liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Prepaid Insurance is an example of a current asset.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of these accounts would appear in the Balance Sheet columns of the end-of-period spreadsheet?

A) Consulting Revenue

B) Prepaid Insurance

C) Rent Expense

D) Fees Earned

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Journalizing and posting the adjustments and closing entries update the ledger for the new accounting period.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

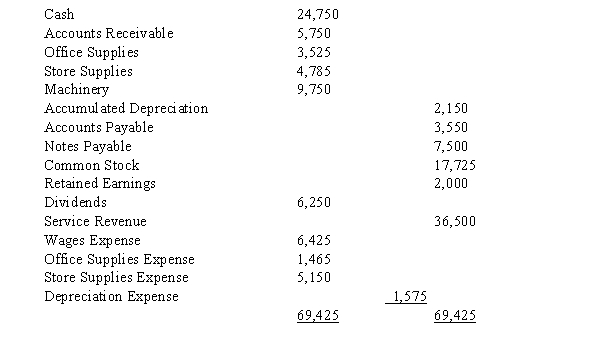

The following adjusted trial balance is the result of the adjustments made at the end of the month of March for Martin Corporation. Use these adjusted values to journalize the closing entries for Martin Corporation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

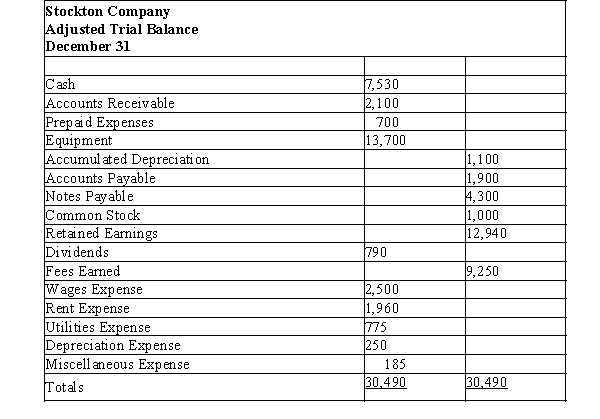

Use the adjusted trial balance for Stockton Company below to answer the questions that follow.  -Determine the net income loss) for the period.

-Determine the net income loss) for the period.

A) net income $9,250

B) net loss $790

C) net loss $5,670

D) net income $3,580

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The post-closing trial balance differs from the adjusted trial balance in that it does not

A) take into account closing entries

B) take into account adjusting entries

C) include balance sheet accounts

D) include income statement accounts

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the accounts below would be closed by posting a debit to the account?

A) Unearned Revenue

B) Fees Earned

C) Dividends

D) Miscellaneous Expense

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The trial balance may be listed on the work sheet instead of being prepared separately.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Deferred expenses that benefit a relatively short period of time are listed on the balance sheet as current assets.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

After all adjustments have been made, but before the accounts have been closed, the following balances were taken from the ledger of Ramona's Designs: Journalize the entries to close the appropriate accounts.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After all of the account balances have been extended to the Balance Sheet columns of the work sheet, the totals of the debit and credit columns show debits of $37,686 and the credits of $41,101. This indicates that

A) neither net income or loss can be calculated because it is found on the income statement

B) the company has a net loss of $3,415 for the period

C) the company has a net income of $3,415 for the period

D) the amounts are out of balance and need to be corrected

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Accumulated Depreciation is a permanent account.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

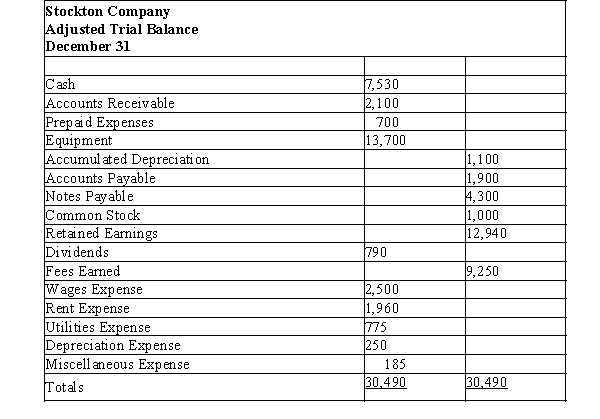

Use the adjusted trial balance for Stockton Company below to answer the questions that follow.  -Determine the retained earnings ending balance.

-Determine the retained earnings ending balance.

A) $12,150

B) $15,730

C) $6,480

D) $21,400

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The work sheet is not considered a part of the formal accounting records.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the steps below is not aided by the preparation of the end-of-period spreadsheet?

A) preparing the adjusted trial balance

B) posting to the general ledger

C) preparing the financial statements

D) preparing the closing entries

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Short Answer

The end-of-period spreadsheet work sheet) for the current year for Jamal Company shows Balance Sheet columns with a debit total of $614,210 and a credit total of $630,430. This is before the amount for net income or net loss has been included. In preparing the income statement from the work sheet, what is the amount of net income or net loss?

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 197

Related Exams