A) debit Salaries Expense; credit Cash

B) debit Pension Expense; credit Unfunded Pension Liability

C) debit Pension Expense; credit Unfunded Pension Liability and Cash

D) debit Pension Expense; credit Cash

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Payroll taxes levied against employees become liabilities

A) the first of the following month

B) when the payroll is paid to employees

C) when data are entered in a payroll register

D) at the end of an accounting period

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Journalize the following transactions for Riley Corporation:Dec. 31The accrued product warranty expense for the year is estimated to be 2.5% of sales. Sales for the year totaled $8,850,000.31The accrued vacation pay for the year is estimated to be $75,000.31Paid First Insurance Co. $55,000 as fund trustee for the pension plan. The annual pension cost is $87,000.

Correct Answer

verified

Correct Answer

verified

Essay

The following information is for employee Ella Dodd for the week ended March 15. Total hours worked: 48 Rate: $15 per hour, with double time for all hours in excess of 40 Federal income tax withheld: $200 United Fund deduction: $50 Cumulative earnings prior to current week: $6,400 Tax rates:Social security: 6.0% on maximum earnings of $120,000 Medicare tax: 1.5% on all earnings State unemployment: 3.4% on maximum earnings of $7,000; on employer Federal unemployment: 0.8% on maximum earnings of $7,000; on employer (a)Determine (1) total earnings, (2) total deductions, and (3) cash paid. (b)Determine each of the employer's payroll taxes related to the earnings of Ella Dodd for the week ended March 15.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use this information for Magnum Company to answer the following questions. The following totals for the month of April were taken from the payroll register of Magnum Company: -The journal entry to record the monthly payroll on April 30 would include a

A) credit to Salaries Payable for $8,150

B) debit to Salaries Expense for $7,902

C) debit to Salaries Payable for $8,150

D) debit to Salaries Payable for $7,902

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On May 18, Rodriguez Co. issued an $84,000, 6%, 120-day note payable on an overdue account payable to Wilson Company. Assume that the fiscal year of Rodriguez ends on June 30. Which of the following relationships is true?

A) Rodriguez is the creditor and credits Accounts Receivable.

B) Wilson is the creditor and debits Accounts Receivable.

C) Wilson is the borrower and credits Accounts Payable.

D) Rodriguez is the borrower and debits Accounts Payable.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The detailed record indicating the data for each employee for each payroll period and the cumulative total earnings for each employee is called the

A) payroll register

B) payroll check

C) employee's earnings record

D) employer's earnings record

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Payroll taxes are based on the employee's net pay.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Payroll entries are made with data from the

A) wage and tax statement

B) employee's earnings record

C) employer's quarterly federal tax return

D) payroll register

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

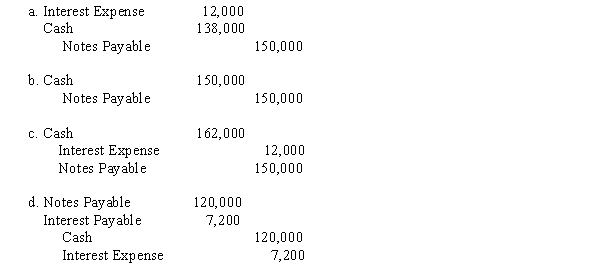

Taylor Bank lends Guarantee Company $150,000 on January 1. Guarantee Company signs a $150,000, 8%, nine-month note. The entry made by Guarantee Company on January 1 to record the proceeds and issuance of the note is

Correct Answer

verified

Correct Answer

verified

Essay

An employee earns $40 per hour and 1.5 times that rate for all hours in excess of 40 hours per week. Assume that the employee worked 60 hours during the week and that the gross pay prior to the current week totaled $58,000. Assume further that the social security tax rate was 6.0%, the Medicare tax rate was 1.5%, and the federal income tax to be withheld was $614. (a) Determine the gross pay for the week. (b) Determine the net pay for the week.

Correct Answer

verified

Correct Answer

verified

Essay

Mobile Sales has five sales employees that receive weekly paychecks. Each earns $11.50 per hour and each has worked 40 hours in the pay period. Each employee pays 12% of gross in federal income tax, 3% in state income tax, 6.0% of gross in social security tax, 1.5% of gross in Medicare tax, and 0.5% in state disability insurance. Journalize the pay period ending January 19 that will be paid to the employees January 26.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of a product warranty should be included as an expense in the

A) period the cash is collected for a product sold on account

B) future period when the cost of repairing the product is paid

C) period of the sale of the product

D) future period when the product is repaired or replaced

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Thomas Martin receives an hourly wage rate of $40, with time-and-a-half pay for all hours worked in excess of 40 hours during a week. Payroll data for the current week are as follows: hours worked, 48; federal income tax withheld, $350; social security tax rate, 6.0%; and Medicare tax rate, 1.5%. What is the gross pay for Martin?

A) $449

B) $1,730

C) $2,080

D) $1,581

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Most employers are required to withhold federal unemployment taxes from employee earnings.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be used to compute the federal income taxes to be withheld from an employee's earnings?

A) FICA tax rate

B) wage and tax statement

C) FUTA tax rate

D) wage bracket and withholding table

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Journalize the following entries on the books of Winston Co. for August 1, September 1, and November 30. (Assume a 360-day year is used for interest calculations.) Aug. 1 Winston Co. purchased merchandise for $75,000 on account from Bagley Co., terms n/30. Sept. 1 Winston Co. issued a 90-day, 6% note for $75,000 on account. Nov. 30Winston Co. paid the amount due.

Correct Answer

verified

Correct Answer

verified

True/False

FICA tax is a payroll tax that is paid only by employers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lee Company has the following information for the pay period of December 15-31:?? Assuming no employees are subject to ceilings for taxes on their earnings, Salaries Payable would be recorded for

A) $16,000

B) $9,808

C) $10,800

D) $11,040

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Young Company has the following assets and liabilities:?? Determine the quick ratio (rounded to one decimal point) .

A) 6.7

B) 13.0

C) 4.2

D) 3.5

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 201

Related Exams