A) $1,776

B) $1,896

C) $4,800

D) $6,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The "luxury auto" cost recovery limits change if mid-quarter cost recovery is used.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An expense need not be recurring in order to be "ordinary."

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On July 10, 2019, Ariff places in service a new SUV that cost $70,000 and weighed 6,300 pounds.The SUV is used 100% for business.Determine Ariff's maximum deduction for 2019, assuming Ariff's § 179 business income is $110,000.Ariff does not take additional first-year depreciation.

A) $2,960

B) $25,000

C) $34,000

D) $70,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

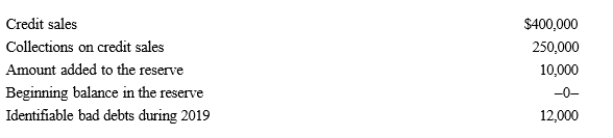

Petal, Inc.is an accrual basis taxpayer.Petal uses the aging approach to calculate the reserve for bad debts.During 2019, the following associated with bad debts occur .  The amount of the deduction for bad debt expense for Petal for 2019 is:

The amount of the deduction for bad debt expense for Petal for 2019 is:

A) $10,000.

B) $12,000.

C) $22,000.

D) $140,000.

E) None of these.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

When a business is being purchased, if possible, the purchaser should bargain for more of the purchase price being allocated to goodwill and covenants not to compete rather than depreciable assets.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If more than 40% of the value of property other than real property is placed in service during the last quarter, all of the property placed in service in the second quarter will be allowed 7.5 months of cost recovery.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

James purchased a new business asset (three-year personalty) on July 23, 2019, at a cost of $40,000.James takes additional first-year depreciation but does not elect Section 179 expense on the asset.Determine the cost recovery deduction for 2019.

A) $8,333

B) $26,666

C) $33,333

D) $40,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

For purposes of the § 267 loss disallowance provision, a taxpayer's aunt is a related party.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On May 2, 2019, Karen placed in service a new sports utility vehicle that cost $60,000 and has a gross vehicle weight of 6,300 lbs.The vehicle is used 60% for business and 40% for personal use.Determine Karen's total cost recovery for 2019.Karen wants to use both §179 and additional first-year depreciation.

A) $7,200

B) $25,500

C) $27,200

D) $36,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2018, Gail had a § 179 deduction carryover of $30,000.In 2019, she elected § 179 for an asset acquired at a cost of $115,000.Gail's § 179 business income limitation for 2019 is $140,000.Determine Gail's § 179 deduction for 2019.

A) $25,000

B) $115,000

C) $130,000

D) $140,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the past two years, through extensive advertising and improved customer relations, Orange Corporation estimated that it had developed customer goodwill worth $500,000.For the current year, determine the amount of goodwill Orange may amortize.

A) $100,000

B) $33,333

C) $26,667

D) $16,667

E) -0-.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On June 1, 2018, Irene places in service a new automobile that cost $21,000.The car is used 70% for business and 30% for personal use.(Assume this percentage is maintained for the life of the car.) She does not take additional first-year depreciation.Determine the cost recovery deduction for 2019.

A) $3,290

B) $3,570

C) $4,704

D) $10,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The cash method can always be used by a corporation even if inventory and cost of goods sold are a significant income-producing factor in the business.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The luxury auto cost recovery limits applies to all automobiles.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Heron Corporation, a calendar year C corporation, had an excess charitable contribution for 2018 of $5,000.In 2019, Heron made a further charitable contribution of $20,000.Heron's 2019 deduction is limited to $15,000 (10% of taxable income).The 2019 contribution must be applied first against the $15,000 limitation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Payments by a cash basis taxpayer of capital expenditures:

A) Must be expensed at the time of payment.

B) Must be expensed by the end of the first year after the asset is acquired.

C) Must be deducted over the actual or statutory life of the asset.

D) Can be deducted in the year the taxpayer chooses.

E) None of these.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A purchased trademark is a § 197 intangible.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Andrew, who operates a laundry business, incurred the following expenses during the year. ∙ Parking ticket of $250 for one of his delivery vans that parked illegally. ∙ Parking ticket of $75 when he parked illegally while attending a rock concert in Tulsa. ∙ DUI ticket of $500 while returning from the rock concert. ∙ Attorney's fee of $600 associated with the DUI ticket. What amount can Andrew deduct for these expenses?

A) $0.

B) $250.

C) $600.

D) $1,425.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Generally, a closely held family corporation is not permitted to take a deduction for a salary paid to a family member in calculating corporate taxable income.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 143

Related Exams