B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A portfolio with a large number of randomly selected stocks would have more market risk than a single stock that has a beta of 0.5, assuming that the stock's beta was correctly calculated and is stable.

B) If a stock has a negative beta, its expected return must be negative.

C) A portfolio with a large number of randomly selected stocks would have less market risk than a single stock that has a beta of 0.5.

D) According to the CAPM, stocks with higher standard deviations of returns must also have higher expected returns.

E) If the returns on two stocks are perfectly positively correlated (i.e., the correlation coefficient is +1.0) and these stocks have identical standard deviations, an equally weighted portfolio of the two stocks will have a standard deviation that is less than that of the individual stocks.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

For a stock to be in equilibrium,two conditions are necessary: (1)The stock's market price must equal its intrinsic value as seen by the marginal investor and (2)the expected return as seen by the marginal investor must equal this investor's required return.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is most likely to occur as you add randomly selected stocks to your portfolio,which currently consists of 3 average stocks?

A) The expected return of your portfolio is likely to decline.

B) The diversifiable risk will remain the same, but the market risk will likely decline.

C) Both the diversifiable risk and the market risk of your portfolio are likely to decline.

D) The total risk of your portfolio should decline, and as a result, the expected rate of return on the portfolio should also decline.

E) The diversifiable risk of your portfolio will likely decline, but the expected market risk should not change.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A has an expected return of 12%,a beta of 1.2,and a standard deviation of 20%.Stock B also has a beta of 1.2,but its expected return is 10% and its standard deviation is 15%.Portfolio AB has $300,000 invested in Stock A and $100,000 invested in Stock B.The correlation between the two stocks' returns is zero (that is,rA,B = 0) .Which of the following statements is CORRECT?

A) The stocks are not in equilibrium based on the CAPM; if A is valued correctly, then B is overvalued.

B) The stocks are not in equilibrium based on the CAPM; if A is valued correctly, then B is undervalued.

C) Portfolio AB's expected return is 11.0%.

D) Portfolio AB's beta is less than 1.2.

E) Portfolio AB's standard deviation is 17.5%.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

DHF Company has a beta of 1.5 and is currently in equilibrium.The required rate of return on the stock is 12.00% versus a required return on an average stock of 10.00%.Now the required return on an average stock increases by 30.0% (not percentage points) .Neither betas nor the risk-free rate change.What would DHF's new required return be?

A) 14.89%

B) 15.68%

C) 16.50%

D) 17.33%

E) 18.19%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A stock's beta measures its diversifiable risk relative to the diversifiable risks of other firms.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The two stocks in your portfolio,X and Y,have independent returns,so the correlation between them,rXY is zero.Your portfolio consists of $50,000 invested in Stock X and $50,000 invested in Stock Y.Both stocks have an expected return of 15%,betas of 1.6,and standard deviations of 30%.Which of the following statements best describes the characteristics of your 2-stock portfolio?

A) Your portfolio has a standard deviation less than 30%, and its beta is greater than 1.6.

B) Your portfolio has a beta equal to 1.6, and its expected return is 15%.

C) Your portfolio has a beta greater than 1.6, and its expected return is greater than 15%.

D) Your portfolio has a standard deviation greater than 30% and a beta equal to 1.6.

E) Your portfolio has a standard deviation of 30%, and its expected return is 15%.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If markets are in equilibrium,which of the following conditions will exist?

A) Each stock's expected return should equal its required return as seen by the marginal investor.

B) All stocks should have the same expected return as seen by the marginal investor.

C) The expected and required returns on stocks and bonds should be equal.

D) All stocks should have the same realized return during the coming year.

E) Each stock's expected return should equal its realized return as seen by the marginal investor.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock X has a beta of 0.7 and Stock Y has a beta of 1.7.Which of the following statements must be true,according to the CAPM?

A) Stock Y's realized return during the coming year will be higher than Stock X's return.

B) If the expected rate of inflation increases but the market risk premium is unchanged, the required returns on the two stocks should increase by the same amount.

C) Stock Y's return has a higher standard deviation than Stock X.

D) If the market risk premium declines, but the risk-free rate is unchanged, Stock X will have a larger decline in its required return than will Stock Y.

E) If you invest $50,000 in Stock X and $50,000 in Stock Y, your 2-stock portfolio would have a beta significantly lower than 1.0, provided the returns on the two stocks are not perfectly correlated.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

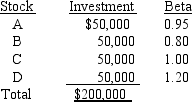

Martin Ortner holds a $200,000 portfolio consisting of the following stocks:  What is the portfolio's beta?

What is the portfolio's beta?

A) 0.938

B) 0.988

C) 1.037

D) 1.089

E) 1.143

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If investors become less averse to risk,the slope of the Security Market Line (SML)will increase.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stocks A and B both have an expected return of 10% and a standard deviation of returns of 25%.Stock A has a beta of 0.8 and Stock B has a beta of 1.2.The correlation coefficient,r,between the two stocks is 0.6.Portfolio P has 50% invested in Stock A and 50% invested in B.Which of the following statements is CORRECT?

A) Based on the information we are given, and assuming those are the views of the marginal investor, it is apparent that the two stocks are in equilibrium.

B) Portfolio P has more market risk than Stock A but less market risk than B.

C) Stock A should have a higher expected return than Stock B as viewed by the marginal investor.

D) Portfolio P has a coefficient of variation equal to 2.5.

E) Portfolio P has a standard deviation of 25% and a beta of 1.0.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stocks A and B are quite similar: Each has an expected return of 12%,a beta of 1.2,and a standard deviation of 25%.The returns on the two stocks have a correlation of 0.6.Portfolio P has 50% in Stock A and 50% in Stock B.Which of the following statements is CORRECT?

A) Portfolio P has a standard deviation that is greater than 25%.

B) Portfolio P has an expected return that is less than 12%.

C) Portfolio P has a standard deviation that is less than 25%.

D) Portfolio P has a beta that is less than 1.2.

E) Portfolio P has a beta that is greater than 1.2.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Even if the correlation between the returns on two securities is +1.0,if the securities are combined in the correct proportions,the resulting 2-asset portfolio will have less risk than either security held alone.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If you plotted the returns of a company against those of the market and found that the slope of your line was negative,the CAPM would indicate that the required rate of return on the stock should be less than the risk-free rate for a well-diversified investor,assuming that the observed relationship is expected to continue in the future.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

It is possible for a firm to have a positive beta,even if the correlation between its returns and those of another firm is negative.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

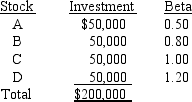

Sherrie Hymes holds a $200,000 portfolio consisting of the following stocks.The portfolio's beta is 0.875.  If Sherrie replaces Stock A with another stock,E,which has a beta of 1.50,what will the portfolio's new beta be?

If Sherrie replaces Stock A with another stock,E,which has a beta of 1.50,what will the portfolio's new beta be?

A) 1.07

B) 1.13

C) 1.18

D) 1.24

E) 1.30

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stocks A,B,and C are similar in some respects: Each has an expected return of 10% and a standard deviation of 25%.Stocks A and B have returns that are independent of one another; i.e.,their correlation coefficient,r,equals zero.Stocks A and C have returns that are negatively correlated with one another; i.e.,r is less than 0.Portfolio AB is a portfolio with half of its money invested in Stock A and half in Stock B.Portfolio AC is a portfolio with half of its money invested in Stock A and half invested in Stock C.Which of the following statements is CORRECT?

A) Portfolio AC has an expected return that is greater than 25%.

B) Portfolio AB has a standard deviation that is greater than 25%.

C) Portfolio AB has a standard deviation that is equal to 25%.

D) Portfolio AC has a standard deviation that is less than 25%.

E) Portfolio AC has an expected return that is less than 10%.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a portfolio of three randomly selected stocks,which of the following could NOT be true; i.e.,which statement is false?

A) The standard deviation of the portfolio is greater than the standard deviation of one or two of the stocks.

B) The beta of the portfolio is lower than the lowest of the three betas.

C) The beta of the portfolio is equal to one of the three stock's betas.

D) The beta of the portfolio is equal to 1.

E) The standard deviation of the portfolio is less than the standard deviation of each of the stocks if they were held in isolation.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 146

Related Exams