A) 31 days

B) 34 days

C) 37 days

D) 41 days

E) 45 days

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fireside Inc.has the following data.What is the firm's cash conversion cycle? Inventory conversion period = 38 days Average collection period 19 days Payables deferral period = 20 days

A) 33 days

B) 37 days

C) 41 days

D) 45 days

E) 49 days

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

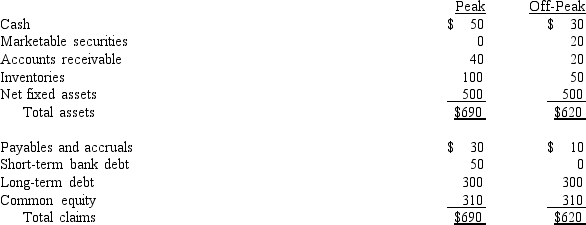

Summary balance sheet data for Greener Gardens Co.is shown below (in thousands of dollars) .The company is in a highly seasonal business,and the data show its assets and liabilities at peak and off-peak seasons:  From this data we may conclude that

From this data we may conclude that

A) Greener Gardens' current asset financing policy is relatively aggressive; that is, the company finances some of its permanent assets with short-term discretionary debt.

B) Greener Gardens follows a relatively conservative approach to current asset financing; that is, some of its short-term needs are met by permanent capital.

C) Without income statement data, we cannot determine the aggressiveness or conservatism of the company's current asset financing policy.

D) Without cash flow data, we cannot determine the aggressiveness or conservatism of the company's current asset financing policy.

E) Greener Gardens' current asset financing policy calls for exactly matching asset and liability maturities.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

One of the effects of ceasing to take trade credit discounts is that the firm's accounts payable will rise,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Famous Farm's payables deferral period (PDP) is 50 days (on a 365-day basis) ,accounts payable are $100 million,and its balance sheet shows inventory of $125 million.What is the inventory turnover ratio?

A) 4.73

B) 5.26

C) 5.84

D) 6.42

E) 7.07

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mark's Manufacturing's average age of accounts receivable is 45 days,the average age of accounts payable is 40 days,and the average age of inventory is 69 days.Assuming a 365-day year,what is the length of its cash conversion cycle?

A) 63 days

B) 67 days

C) 70 days

D) 74 days

E) 78 days

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

For a zero-growth firm,it is possible to increase the percentage of sales that are made on credit and still keep accounts receivable at their current level,provided the firm can shorten the length of its collection period sufficiently.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a firm that sells on terms of net 30 changes its policy to 2/10 net 30, and if no change in sales volume occurs, then the firm's DSO will probably increase.

B) If a firm sells on terms of 2/10 net 30, and its DSO is 30 days, then the firm probably has some past-due accounts.

C) If a firm sells on terms of net 60, and if its sales are highly seasonal, with a sharp peak in December, then its DSO as it is typically calculated (with sales per day = Sales for past 12 months/365) would probably be lower in January than in July.

D) If a firm changed the credit terms offered to its customers from 2/10 net 30 to 2/10 net 60, then its sales should increase, and this should lead to an increase in sales per day, and that should lead to a decrease in the DSO.

E) Other things held constant, the higher a firm's days sales outstanding (DSO) , the better its credit department.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A lockbox plan is most beneficial to firms that

A) have widely dispersed manufacturing facilities.

B) have a large marketable securities portfolio and cash to protect.

C) receive payments in the form of currency, such as fast food restaurants, rather than in the form of checks.

D) have customers who operate in many different parts of the country.

E) have suppliers who operate in many different parts of the country.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If cash inflows from collections occur in equal daily amounts but most payments must be made on the 10th of each month, then a regular monthly cash budget will be misleading. The problem can be corrected by using a daily cash budget.

B) Sound working capital policy is designed to maximize the time between cash expenditures on materials and the collection of cash on sales.

C) If a firm wants to generate more cash flow from operations in the next month or two, it could change its credit policy from 2/10 net 30 to net 60.

D) If a firm sells on terms of net 90, and if its sales are highly seasonal, with 80% of its sales in September, then its DSO as it is typically calculated (with sales per day = Sales for past 12 months/365) would probably be lower in October than in August.

E) Depreciation is included in the estimate of cash flows (Cash flow = Net income = Depreciation) ; hence depreciation is set forth on a separate line in the cash budget.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Synchronization of cash flows is an important cash management technique,as proper synchronization can reduce the required cash balance and increase a firm's profitability.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Since depreciation is a non-cash charge,it neither appears on nor has any effect on the cash budget.Thus,if the depreciation charge for the coming year doubled or halved,this would have no effect on the cash budget.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A firm's collection policy,i.e.,the procedures it follows to collect accounts receivable,plays an important role in keeping its average collection period short,although too strict a collection policy can reduce profits due to lost sales.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Other things held constant,if a firm "stretches" (i.e.,delays paying)its accounts payable,this will lengthen its cash conversion cycle (CCC).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Suppose a firm changes its credit policy from 2/10 net 30 to 3/10 net 30.The change is meant to meet competition,so no increase in sales is expected.The average accounts receivable balance will probably decline as a result of this change.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Since receivables and payables both result from sales transactions,a firm with a high receivables-to-sales ratio must also have a high payables-to-sales ratio.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Howes Inc.purchases $4,562,500 in goods per year from its sole supplier on terms of 2/15,net 50.If the firm chooses to pay on time but does not take the discount,what is the effective annual percentage cost of its non-free trade credit? (Assume a 365-day year.)

A) 20.11%

B) 21.17%

C) 22.28%

D) 23.45%

E) 24.63%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

As a rule,managers should try to always use the free component of trade credit but should use the costly component only if the cost of this credit is lower than the cost of credit from other sources.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Commercial paper is a form of short-term financing that is primarily used by large, strong, financially stable companies.

B) Short-term debt is favored by firms because, while it is generally more expensive than long-term debt, it exposes the borrowing firm to less risk than long-term debt.

C) Commercial paper can be issued by virtually any firm so long as it is willing to pay the going interest rate.

D) Commercial paper is typically offered at a long-term maturity of at least five years.

E) Trade credit is provided only to relatively large, strong firms.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

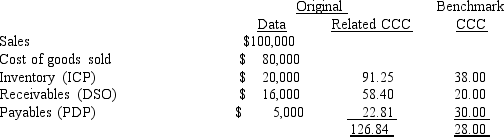

Fontana Painting had the following data for the most recent year (in millions) .The new CFO believes that the company could improve its working capital management sufficiently to bring its NWC and CCC up to the benchmark companies' level without affecting either sales or the costs of goods sold.Fontana finances its net working capital with a bank loan at an 8% annual interest rate,and it uses a 365-day year.If these changes had been made,by how much would the firm's pre-tax income have increased?

A) 1,901

B) 2,092

C) 2,301

D) 2,531

E) 2,784

G) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 135

Related Exams