B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

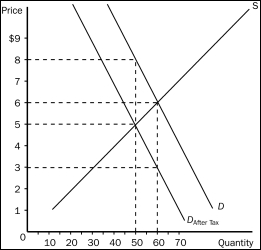

Figure 6-8

-Refer to Figure 6-8.The equilibrium price in the market before the tax is imposed is

-Refer to Figure 6-8.The equilibrium price in the market before the tax is imposed is

A) $8.

B) $6.

C) $5.

D) $3.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

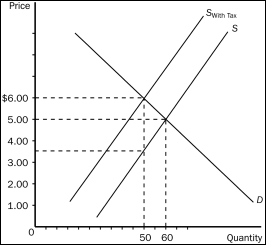

Figure 6-10

-Suppose the same S and D curves apply, and a tax of the same amount per unit as shown here is imposed. Now, however, the buyers of the good, rather than the sellers, are required to pay the tax to the government. Now,

-Suppose the same S and D curves apply, and a tax of the same amount per unit as shown here is imposed. Now, however, the buyers of the good, rather than the sellers, are required to pay the tax to the government. Now,

A) the burden on buyers will be larger than in the case illustrated in Figure 6-10.

B) the burden on sellers will be smaller than in the case illustrated in Figure 6-10.

C) a downward shift of the demand curve replaces the upward shift of the supply curve.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A price floor is not binding if

A) the price floor is higher than the equilibrium price of the good.

B) the quantity of the good demanded with the price floor is less than the quantity demanded of the good without the price floor.

C) the quantity of the good supplied with the price floor is less than the quantity supplied of the good without the price floor.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the demand curve for motorcycles slopes downward and the supply curve for motorcycles slopes upward.If the government passes a law requiring buyers of motorcycles to send $500 to the government for every motorcycle they buy,then

A) the demand curve for motorcycles shifts downward by $500.

B) buyers of motorcycles pay $500 more per motorcycle than they were paying before the tax.

C) sellers of motorcycles are unaffected by the tax.

D) All of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax imposed on the sellers of a good

A) raises both the price buyers pay and the effective price for sellers.

B) raises the price buyers pay and lowers the effective price for sellers.

C) lowers the price buyers pay and raises the effective price for sellers.

D) lowers both the price buyers pay and the effective price for sellers.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

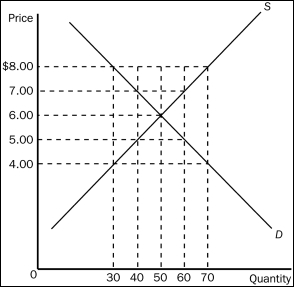

Figure 6-4

-Refer to Figure 6-4.Suppose a price ceiling of $4.50 is imposed.As a result,

-Refer to Figure 6-4.Suppose a price ceiling of $4.50 is imposed.As a result,

A) there is a shortage of 15 units of the good.

B) the demand curve will shift to the left so as to now pass through the point (Q = 35, P = $4.50) .

C) the situation is very much like the one created by a binding minimum wage.

D) the quantity of the good that is bought and sold is the same as it would have been had a price floor of $7.50 been imposed.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose sellers of liquor are required to send $1.00 to the government for every bottle of liquor they sell.Further,suppose this tax causes the price paid by buyers of liquor to rise by $0.80 per bottle.Which of the following statements is correct?

A) This tax causes the demand curve for liquor to shift downward by $0.80 at each quantity of liquor.

B) The incidence of the tax is summarized by the fact that sellers send the tax payments to the government.

C) Eighty percent of the burden of the tax falls on buyers.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

How does elasticity affect the burden of a tax? Justify your answer using supply and demand diagrams.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

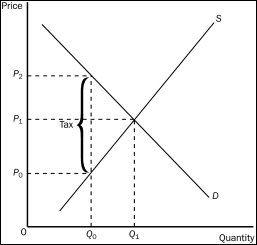

Figure 6-13

-Refer to Figure 6-13.The per-unit burden of the tax on buyers is

-Refer to Figure 6-13.The per-unit burden of the tax on buyers is

A) P₂ minus P₀.

B) P₂ minus P₁.

C) P₁ minus P₀.

D) Q₁ minus Q₀.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the demand curve for a good is very flat and the supply curve for the good is very steep.If the government taxes this good,

A) buyers and sellers will each share 50 percent of the burden, regardless of the slopes of the demand and supply curves.

B) sellers will bear a larger share of the tax burden and buyers will bear a smaller share of the burden.

C) the distribution of the burden will depend upon whether the buyers or the sellers are required to send the tax to the government.

D) the amount of tax revenue collected by the government will depend upon whether the buyers or the sellers are required to send the tax to the government.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A binding price floor causes

A) excess demand.

B) a shortage.

C) a surplus.

D) quantity demanded to exceed quantity supplied.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The goal of a rent-control policy is to

A) facilitate controlled economic experiments in urban areas.

B) help landlords by assuring them a low vacancy rate for their apartments.

C) help the poor by assuring them an adequate supply of apartments.

D) help the poor by making housing more affordable.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

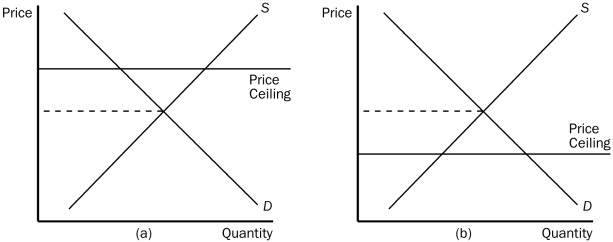

Figure 6-1

-Refer to Figure 6-1.The situation in panel (a) may be described as one in which

-Refer to Figure 6-1.The situation in panel (a) may be described as one in which

A) the price ceiling is not binding.

B) the price "ceiling" really functions as a price floor.

C) a surplus of the good will be observed.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The federal government uses the revenue from the FICA (Federal Insurance Contribution Act) tax to pay for

A) unemployment compensation.

B) flood insurance.

C) Social Security and Medicare.

D) housing subsidies for low-income people.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The incidence of a tax depends on whether the tax is levied on buyers or sellers.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The housing shortages caused by rent controls are larger in the long run than in the short run because both the supply of housing and the demand for housing are more elastic in the long run.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S.Congress first instituted a minimum wage in

A) 1890.

B) 1914.

C) 1938.

D) 1974.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the equilibrium price of a physical examination ("physical") by a doctor is $200,and the government imposes a price ceiling of $150 per physical.As a result of the price ceiling,

A) the demand curve for physicals shifts to the right.

B) the supply curve for physicals shifts to the left.

C) the quantity demanded of physicals increases and the quantity supplied of physicals decreases.

D) the number of physicals performed will increase.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When OPEC raised the price of crude oil in the 1970s,it caused the

A) supply of gasoline to decrease.

B) quantity of gasoline demanded to decrease.

C) equilibrium price of gasoline to increase.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 252

Related Exams