A) 26.4%

B) 27.8%

C) 30%

D) 35%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

John and Rachelle face a proportional tax structure with a marginal tax rate of 25 percent.John and Rachelle each earn $60,000 per year.If John and Rachelle get married,the "marriage tax" will be

A) 0

B) $3,750

C) $15,000

D) $30,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A mortgage interest deduction would be considered

A) tax evasion.

B) a subsidy to the poor.

C) a deduction that benefits all members of society equally.

D) a tax loophole.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a state levies a sales tax,the tax

A) is paid only by the state's residents.

B) occasionally excludes items that are deemed to be necessities.

C) is commonly levied on labor services.

D) applies to wholesale purchases but not retail purchases.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When compared to nonpoor countries,poor countries usually have

A) very high tax burdens.

B) similar tax burdens.

C) relatively low tax burdens.

D) no taxes because of high poverty levels.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a way that a corporate tax on the income of U.S.car companies will affect markets?

A) The price of cars will rise.

B) The wages of auto workers will fall.

C) Owners of car companies (stockholders) will receive less profit.

D) Less deadweight loss will occur since corporations are entities and not people who respond to incentives.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The administrative burden of complying with the tax laws is a cost to the government but not to taxpayers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vertical equity states that taxpayers with a greater ability to pay taxes should

A) contribute a decreasing proportion of each increment in income to taxes.

B) contribute a larger amount than those with a lesser ability to pay.

C) be less subject to administrative burdens of a tax.

D) be less subject to tax distortions that lead to deadweight losses.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tim earns income of $60,000 per year and pays $21,000 per year in taxes.Tim paid 20 percent in taxes on the first $30,000 he earned.What was the marginal tax rate on the second $30,000 he earned?

A) 20 percent

B) 30 percent

C) 50 percent

D) 70 percent

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With a lump-sum tax,the

A) marginal tax rate is always less than the average tax rate.

B) average tax rate is always less than the marginal tax rate.

C) marginal tax rate falls as income rises.

D) marginal tax rate rises as income rises.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Corporate profits distributed as dividends are

A) tax free.

B) taxed once.

C) double taxed.

D) triple taxed.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

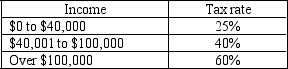

Table 12-6

-Refer to Table 12-6.What is the marginal tax rate for a person who makes $35,000?

-Refer to Table 12-6.What is the marginal tax rate for a person who makes $35,000?

A) 25%

B) 30%

C) 40%

D) 60%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

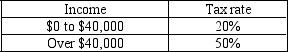

Table 12-5

-Refer to Table 12-5.What is the average tax rate for a person who makes $60,000?

-Refer to Table 12-5.What is the average tax rate for a person who makes $60,000?

A) 20%

B) 30%

C) 40%

D) 50%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) A general sales tax on food is regressive when low-income taxpayers spend a larger proportion of their income on food than high-income taxpayers.

B) A general sales tax on food is regressive when middle income taxpayers spend a smaller proportion of their income on food than high-income taxpayers.

C) A general sales tax on food is regressive when high-income taxpayers spend a larger proportion of their income on food than middle income taxpayers.

D) A general sales tax on food is regressive when high-income taxpayers spend a larger proportion of their income on food than low-income taxpayers.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Becky's average tax rate on her November income is 15 percent.The marginal tax rate on her December income of $10,000 exceeds her average tax rate.The tax liability on her December income will be

A) less than $1,500.

B) exactly equal $1,500.

C) greater than $1,500.

D) From the information provided, any of the answers above could be correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The concept that people should pay taxes based on the benefits they receive from government services is called

A) the ability-to-pay principle.

B) the benefits principle.

C) horizontal equity.

D) vertical equity.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pat calculates that for every extra dollar she earns,she owes the government 33 cents.Her total income now is $35,000,on which she pays taxes of $7,000.Determine her average tax rate and her marginal tax rate.

A) 33% and 20%, respectively

B) 20% and 33%, respectively

C) 20% and 20%, respectively

D) 33% and 33%, respectively

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The federal healthcare spending program that specifically targets the poor is called

A) Medicaid.

B) Medicare.

C) National Institutes of Health.

D) Blue Cross/Blue Shield.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-1 Suppose Jim and Joan receive great satisfaction from their consumption of cheesecake. Joan would be willing to purchase only one slice and would pay up to $6 for it. Jim would be willing to pay $9 for his first slice, $7 for his second slice, and $3 for his third slice. The current market price is $3 per slice. -Refer to Scenario 12-1.How much total consumer surplus do Joan and Jim collectively receive from consuming cheesecake?

A) $3

B) $6

C) $9

D) $13

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

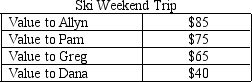

Table 12-3

-Refer to Table 12-3.Assume that the price of a weekend ski pass is $38 and that the price reflects the actual unit cost of providing a weekend of skiing.How much consumer surplus accrues to Allyn and Greg individually?

-Refer to Table 12-3.Assume that the price of a weekend ski pass is $38 and that the price reflects the actual unit cost of providing a weekend of skiing.How much consumer surplus accrues to Allyn and Greg individually?

A) $85 and $65 respectively

B) $49 and $35 respectively

C) $47 and $27 respectively

D) $37 and $17 respectively

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 301 - 320 of 328

Related Exams