A) at the top of the Laffer curve.

B) on the positively sloped part of the Laffer curve.

C) on the negatively sloped part of the Laffer curve.

D) experiencing small deadweight losses.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Ashley needs a dog sitter so that she can travel to her sister's wedding.Ashley values dog sitting for the weekend at $200.Cami is willing to dog sit for Ashley so long as she receives at least $175.Ashley and Cami agree on a price of $185.Suppose the government imposes a tax of $30 on dog sitting.What is the deadweight loss of the tax?

A) the maximum value that Ashley would pay for dog sitting

B) the $30 tax

C) the lost benefit to Ashley and Cami because after the tax,Cami will not dog sit for Ashley

D) the lost benefit to Ashley of being unable to hire a dog sitter because Ashley is the one who would pay the tax

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

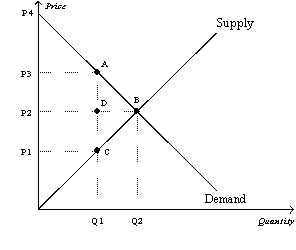

Figure 8-3

The vertical distance between points A and C represents a tax in the market.  -Refer to Figure 8-3.The equilibrium price before the tax is imposed is

-Refer to Figure 8-3.The equilibrium price before the tax is imposed is

A) P1.

B) P2.

C) P3.

D) P4.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the labor supply curve is nearly vertical,a tax on labor

A) has a large deadweight loss.

B) raises a small amount of tax revenue.

C) has little impact on the amount of work that workers are willing to do.

D) results in a large tax burden on the firms that hire labor.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Economist Arthur Laffer made the argument that tax rates in the United States were so high that reducing the rates would increase tax revenue.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The elasticities of the supply and demand curves in the market for cigarettes affect how much a tax distorts that market.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would likely have the smallest deadweight loss relative to the tax revenue?

A) a head tax (that is,a tax everyone must pay regardless of what one does or buys)

B) an income tax

C) a tax on compact discs

D) a tax on caviar

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

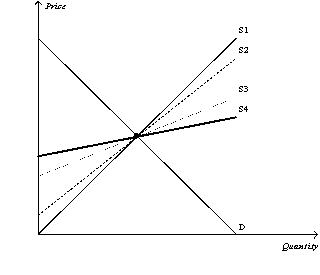

Figure 8-16  -Refer to Figure 8-16.Suppose the government imposes a $1 tax in each of the four markets represented by supply curves S1,S2,S3,and S4.The deadweight will be the smallest in the market represented by

-Refer to Figure 8-16.Suppose the government imposes a $1 tax in each of the four markets represented by supply curves S1,S2,S3,and S4.The deadweight will be the smallest in the market represented by

A) S1.

B) S2.

C) S3.

D) S4.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

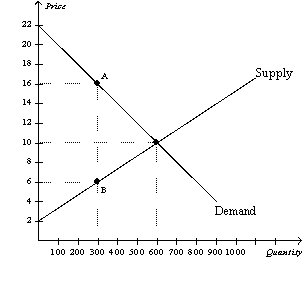

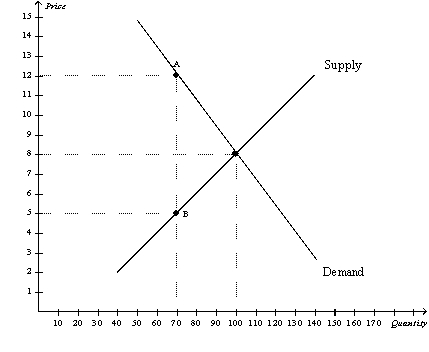

Figure 8-6

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-6.What happens to consumer surplus when the tax is imposed in this market?

-Refer to Figure 8-6.What happens to consumer surplus when the tax is imposed in this market?

A) Consumer surplus falls by $3,600.

B) Consumer surplus falls by $2,700.

C) Consumer surplus falls by $1,800.

D) Consumer surplus falls by $900.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the tax on a good is doubled,the deadweight loss of the tax

A) increases by 50 percent.

B) doubles.

C) triples.

D) quadruples.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

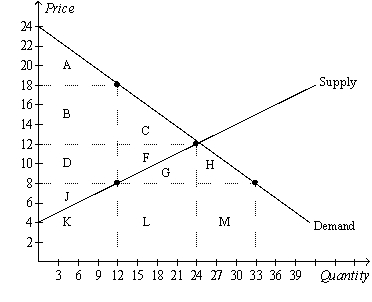

Figure 8-8

Suppose the government imposes a $10 per unit tax on a good.  -Refer to Figure 8-8.The deadweight loss of the tax is the area

-Refer to Figure 8-8.The deadweight loss of the tax is the area

A) B+D.

B) C+F.

C) A+C+F+J.

D) B+C+D+F.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economists generally agree that the most important tax in the U.S.economy is the

A) income tax.

B) tax on labor.

C) inheritance or death tax.

D) tax on corporate profits.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider a good to which a per-unit tax applies.The greater the price elasticities of demand and supply for the good,the

A) smaller the deadweight loss from the tax.

B) greater the deadweight loss from the tax.

C) more efficient is the tax.

D) more equitable is the distribution of the tax burden between buyers and sellers.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Because taxes distort incentives,they cause markets to allocate resources inefficiently.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Taxes affect market participants by increasing the price paid by the buyer and decreasing the price received by the seller.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Relative to a situation in which gasoline is not taxed,the imposition of a tax on gasoline causes the quantity of gasoline demanded to

A) decrease and the quantity of gasoline supplied to decrease.

B) decrease and the quantity of gasoline supplied to increase.

C) increase and the quantity of gasoline supplied to decrease.

D) increase and the quantity of gasoline supplied to increase.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax shifts the demand curve upward (or to the right) ,we can infer that the tax was levied on

A) buyers of the good.

B) sellers of the good.

C) both buyers and sellers of the good.

D) We cannot infer anything because the shift described is not consistent with a tax.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-4

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-4.The tax results in a loss of consumer surplus that amounts to

-Refer to Figure 8-4.The tax results in a loss of consumer surplus that amounts to

A) $120.

B) $340.

C) $450.

D) $510.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

When a tax is imposed on buyers,consumer surplus and producer surplus both decrease.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The benefit to buyers of participating in a market is measured by

A) the price elasticity of demand.

B) consumer surplus.

C) the maximum amount that buyers are willing to pay for the good.

D) the equilibrium price.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 201 - 220 of 421

Related Exams