A) perpetuity.

B) an intermediary bond.

C) an indexed bond.

D) a junk bond.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You observe a closed economy that has a government deficit and positive investment.Which of the following is correct?

A) Private and public saving are both positive.

B) Private saving is positive; public saving is negative.

C) Private saving is negative; public saving is positive.

D) Both private saving and public saving are negative.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government finds a major defect in one of a company's products and demands that the product be taken off the market.We would expect that the

A) supply of existing shares of the stock and the price will both rise.

B) supply of existing shares of the stock and the price will both fall.

C) demand for existing shares of the stock and the price will both rise.

D) demand for existing shares of the stock and the price will both fall.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have some estimates of national accounts numbers for a closed economy for the coming year.Under one set of expectations,government purchases will be $30 billion,transfer payments will be $10 billion,and taxes will be $45 billion.Under another set of expectations,GDP will be $200 billion,taxes will be $50 billion,transfer payments will be $20 billion,consumption will be $120 million,and investment will be $40 billion.Based on these numbers in the first case there should be a

A) $15 billion surplus,and in the second case a $10 billion surplus.

B) $15 billion surplus,and in the second case a $10 billion deficit.

C) $5 billion surplus,and in the second case a $10 billion surplus.

D) $5 billion surplus,and in the second case a $10 billion deficit.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

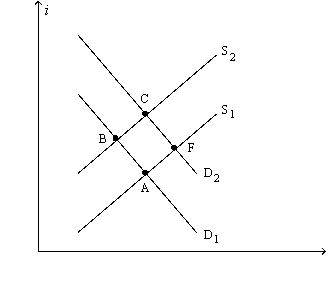

Figure 18-3.The figure shows two demand-for-loanable-funds curves and two supply-of-loanable-funds curves.  -Refer to Figure 18-3.What,specifically,does the label on the vertical axis,i,represent?

-Refer to Figure 18-3.What,specifically,does the label on the vertical axis,i,represent?

A) the nominal interest rate

B) the real interest rate

C) the inflation rate

D) the dividend yield

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a large,well-known corporation wishes to borrow directly from the public,it can

A) sell bonds.

B) sell shares of stock.

C) go to a bank for a loan.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two bonds have the same term to maturity.The first was issued by a state government and the probability of default is believed to be low.The other was issued by a corporation and the probability of default is believed to be high.Which of the following is correct?

A) Because they have the same term to maturity the interest rates should be the same.

B) Because of the differences in tax treatment and credit risk,the state bond should have the higher interest rate.

C) Because of the differences in tax treatment and credit risk,the corporate bond should have the higher interest rate.

D) It is not possible to say if one bond has a higher interest rate than the other.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Volume,as reported in stock tables,refers to the

A) number of shares traded.

B) percentage of shares outstanding traded.

C) number of shares traded times the price they sold at.

D) number of shares of a company traded divided by the shares of all companies traded.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 18-2.Assume the following information for an imaginary,closed economy. GDP = $200,000; consumption = $120,000; government purchases = $35,000; and taxes = $25,000. -Refer to Scenario 18-2.For this economy,investment amounts to

A) $25,000.

B) $30,000.

C) $35,000.

D) $45,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If,for an imaginary closed economy,investment amounts to $12,000 and the government is running a $2,000 deficit,then private saving must amount to $10,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a certificate of indebtedness?

A) both stocks and bonds

B) stocks but not bonds

C) bonds but not stocks

D) neither stocks nor bonds

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The financial system coordinates investment and saving,which are important determinants of long-run real GDP.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) Joan takes some of her income and buys mutual fund shares.Joan's purchase will be included in the investment category of GDP.

B) If a share of stock in Virtual Pizza Corporation sells for $77,the earnings per share are $5,and the dividend per share is $2,then the P/E ratio is 11.

C) In order to use equity finance,a firm must sell about equal values of stocks and bonds.

D) None of the above is correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Anything other than a change in the interest rate that decreases national saving shifts the supply of loanable funds to the left.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Morgan,a financial advisor,has told her clients the following things.Which of her statements is not correct?

A) "U.S.government bonds generally pay a higher rate of interest than corporate bonds."

B) "The interest received on corporate bonds is taxable."

C) "U.S.government bonds have the lowest default risk."

D) "If you purchase a municipal bond,you can sell it before it matures."

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the issuer of a bond fails to pay some of the interest or principal that was promised to the bondholders.This failure is referred to as a

A) breach.

B) default.

C) risk.

D) term failure.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

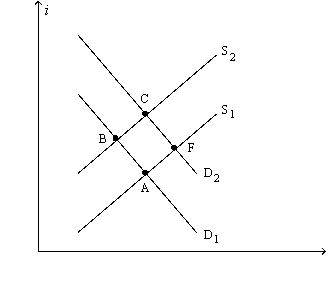

Figure 18-3.The figure shows two demand-for-loanable-funds curves and two supply-of-loanable-funds curves.  -Refer to Figure 18-3.A shift of the demand curve from D1 to D2 is called

-Refer to Figure 18-3.A shift of the demand curve from D1 to D2 is called

A) an increase in the demand for loanable funds,and that increase would originate from people who had some extra income they wanted to lend.

B) an increase in the demand for loanable funds,and that increase would originate from households and firms who wish to borrow to make investments.

C) a decrease in the demand for loanable funds,and that decrease would originate from people who had some extra income they wanted to lend.

D) a decrease in the demand for loanable funds,and that decrease would originate from households and firms who wish to borrow to make investments.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose in some country that the first $5,000 of interest income is exempt from income tax.If the government then removed this exemption

A) the interest rate and investment would rise.

B) the interest rate would rise and investment would fall.

C) the interest rate would fall and investment would rise.

D) the interest rate and investment would fall.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

It is claimed that mutual funds have two advantages.The first is that mutual funds allow people with small amounts of money to diversify.The second is that mutual funds provide the skills of professional money managers who buy stocks they believe will be the most profitable and thereby increase the return that mutual fund depositors earn on their savings.

A) Economists strongly agree with both claims.

B) Economists are skeptical of both claims.

C) Economists are skeptical of the first claim,but strongly agree with the second.

D) Economists strongly agree with the first claim,but are skeptical of the second.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

World Wide Delivery Service Corporation develops a way to speed up its deliveries and reduce its costs.We would expect that this would

A) raise the demand for existing shares of the stock,causing the price to rise.

B) decrease the demand for existing shares of the stock,causing the price to fall.

C) raise the supply of the existing shares of stock,causing the price to rise.

D) raise the supply of the existing shares of stock,causing the price to fall.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 470

Related Exams