A) 1.99 percent

B) 2.86 percent

C) 1.21 percent

D) 2.24 percent

E) 1.42 percent

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Goshen Industrial Sales has sales of $487,600,total equity of $367,700,a profit margin of 5.1 percent,and a debt-equity ratio of .34.What is the return on assets?

A) 5.89 percent

B) 5.05 percent

C) 6.76 percent

D) 8.80 percent

E) 7.33 percent

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Wood Shed has cash of $5,800,accounts receivable of $18,600,inventory of $53,100,and net working capital of $2,100.What is the cash ratio?

A) .11

B) .08

C) .26

D) .21

E) .45

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Computer Geeks has sales of $618,900,a profit margin of 13.2 percent,a total asset turnover rate of 1.54,and an equity multiplier of 1.06.What is the return on equity?

A) 18.91 percent

B) 12.67 percent

C) 18.28 percent

D) 22.11 percent

E) 21.55 percent

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dellf's has a profit margin of 3.8 percent on sales of $287,200.The firm currently has 5,000 shares of stock outstanding at a market price of $7.11 per share.What is the price-earnings ratio?

A) 3.26

B) 8.02

C) 11.50

D) 5.93

E) 12.84

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gently Used Goods has cash of $2,950,inventory of $28,470,fixed assets of $9,860,accounts payable of $11,900,and accounts receivable of $4,660.What is the cash ratio?

A) .08

B) .25

C) .30

D) .46

E) .51

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taylor,Inc.has sales of $11,898,total assets of $9,315,and a debt-equity ratio of .55.If its return on equity is 14 percent,what is its net income?

A) $841.35

B) $887.16

C) $904.10

D) $911.16

E) $927.46

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm has adopted a policy whereby it will not seek any additional external financing.Given this,what is the maximum growth rate for the firm if it has net income of $32,600,total equity of $294,000,total assets of $503,000,and a 25 percent dividend payout ratio?

A) 5.11 percent

B) 4.88 percent

C) 6.62 percent

D) 7.67 percent

E) 8.37 percent

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

AZ Sales has total revenue of $318,400,cost of goods sold equal to 72 percent of sales,and a profit margin of 8.1 percent.Net fixed assets are $154,500 and current assets are $89,500.What is the total asset turnover rate?

A) 1.08

B) 1.38

C) 1.30

D) 1.24

E) 1.28

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fresh Foods has sales of $213,600,total assets of $198,700,a debt-equity ratio of 1.43,and a profit margin of 4.8 percent.What is the equity multiplier?

A) .30

B) .43

C) 1.93

D) 2.43

E) 2.30

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The DuPont identity can be accurately defined as:

A) Return on equity xTotal asset turnover xEquity multiplier.

B) Equity multiplier xReturn on assets.

C) Profit margin xReturn on equity.

D) Total asset turnover xProfit margin xDebt-equity ratio.

E) Equity multiplier xReturn on assets Profit margin.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

High Road Transport has a current stock price of $5.60.For the past year,the company had net income of $287,400,total equity of $992,300,sales of $1,511,000,and 750,000 shares outstanding.What is the market-to-book ratio?

A) 3.54

B) 3.81

C) 3.99

D) 4.47

E) 4.23

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm wishes to maintain an internal growth rate of 4.5 percent and a dividend payout ratio of 60 percent.The current profit margin is 7.5 percent and the firm uses no external financing sources.What must be the total asset turnover?

A) .98

B) 1.06

C) 1.21

D) 1.44

E) 1.59

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Phil's Carvings sells its inventory in 93 days,on average.Costs of goods sold for the year are $187,200.What is the average value of the firm's inventory? Assume a 365-day year.

A) $20,129

B) $47,698

C) $57,132

D) $61,096

E) $32,513

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kessler Cleaners has accounts receivable of $28,943,total assets of $387,600,cost of goods sold of $317,400,and a capital intensity ratio of .97.What is the accounts receivable turnover rate?

A) 12.63

B) 13.81

C) 12.42

D) 14.61

E) 10.97

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lawler's BBQ has sales of $311,800,a profit margin of 3.9 percent,and dividends of $4,500.What is the plowback ratio?

A) 46.32 percent

B) 49.78 percent

C) 50.23 percent

D) 58.09 percent

E) 62.99 percent

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Dry Dock has inventory of $431,700,accounts payable of $94,200,cash of $51,950,and accounts receivable of $103,680.What is the cash ratio?

A) .64

B) .55

C) .53

D) .98

E) 1.34

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

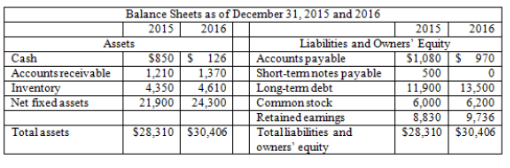

Use the following financial information to answer this question.

What are the values of the three components of the DuPont identity? Use ending balance sheet values.

What are the values of the three components of the DuPont identity? Use ending balance sheet values.

A) .1168; 1.01; .5241

B) .1153; 1.01; .4259

C) .1153; 1.01; 1.9080

D) .1168; .99; .5241

E) .1153; .99; 1.9080

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Towne Realty has total assets of $346,200,net fixed assets of $277,400,current liabilities of $16,100,and long-term liabilities of $124,600.What is the total debt ratio?

A) .47

B) .41

C) .68

D) .56

E) .52

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Turner's Store had a profit margin of 6.8 percent,sales of $498,200,and total assets of $542,000.If management set a goal of increasing the total asset turnover to 1.10 times,what would the new sales figure need to be,assuming no increase in total assets?

A) $467,185

B) $492,727

C) $488,500

D) $596,200

E) $657,480

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 119

Related Exams