B) False

Correct Answer

verified

Correct Answer

verified

True/False

Passive investment income includes net capital gains from the sale of stocks and securities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An S shareholder's stock basis is reduced by flow-through losses before accounting for distributions.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

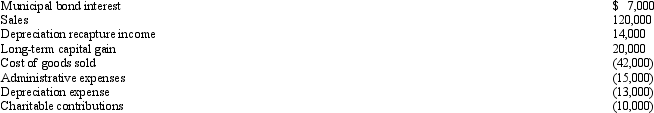

Estela,Inc. ,a calendar year S corporation,incurred the following items in 2012.

Calculate Estela's nonseparately computed income.

Calculate Estela's nonseparately computed income.

Correct Answer

verified

Correct Answer

verified

Short Answer

Since loss property receives a ____________________ in basis without any loss recognition,S corporation distributions of loss property should be ____________________.

Correct Answer

verified

Correct Answer

verified

True/False

An S shareholder's basis is not decreased by distributions treated as being paid from AAA.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which item does not appear on Schedule K of Form 1120S?

A) Tax-exempt interest income.

B) Section 1231 gain.

C) Section 179 expense deduction.

D) Depreciation recapture income.

E) All of the above appear on Schedule K.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

An S corporation's separately stated items are identical to those separately stated by partnerships.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Claude Bergeron sold 1,000 shares of Ditta,Inc. ,an S corporation,for $12,000.He had owned the stock for three years and had a stock basis of $111,000 in the shares.Claude is single,and he is the original owner of the § 1244 stock shares.Calculate the appropriate tax treatment.

A) No gain or loss.

B) $50,000 LTCL;$49,000 ordinary deduction.

C) $50,000 ordinary deduction;$49,000 LTCL.

D) $99,000 long-term capital loss.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During 2012,Dana Rippel,the sole shareholder of a calendar year S corporation,received a distribution of $16,000.On December 31,2011,her stock basis was $4,000.The corporation earned $11,000 ordinary income during the year.It has no accumulated E & P.Which statement is correct?

A) Rippel recognizes a $1,000 LTCG.

B) Rippel's stock basis will be $2,000.

C) Rippel's ordinary income is $15,000.

D) Rippel's return of capital is $11,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

An S corporation does not recognize a loss when distributing assets that are worth less than their basis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which tax provision does not apply to an S corporation?

A) DPAD.

B) Section 1244 stock.

C) Penalty for failure to file.

D) 10% charitable contribution limitation.

E) Estimated tax payments.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

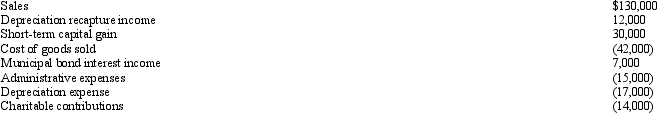

Bidden,Inc. ,a calendar year S corporation,incurred the following items.

Calculate Bidden's nonseparately computed income.

Calculate Bidden's nonseparately computed income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is incorrect with respect to filing an S election?

A) Form 2553 must be filed.

B) All shareholders must consent.

C) The election may be filed in the previous year.

D) An extension of time is available for filing Form 2553.

E) None of the above statements is incorrect.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Several individuals acquire assets on behalf of Skip Corporation on May 28,2012,purchased assets on June 3,2012,and began business on June 11,2012.They subscribe to shares of stock,file articles of incorporation for Skip,and become shareholders on June 21,2012.The S election must be filed no later than 2 1/2 months after:

A) May 28,2012.

B) June 3,2012.

C) June 11,2012.

D) June 21,2012.

E) December 31,2012.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a resident alien shareholder moves outside the U.S. ,the S election is terminated.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

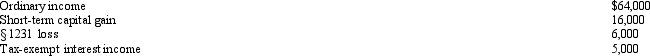

Trent Huynh is a 45% owner of a calendar year S corporation during 2012.His beginning stock basis is $292,000,and the S corporation reports the following items.

Calculate Huynh's stock basis at year-end.

Calculate Huynh's stock basis at year-end.

Correct Answer

verified

Correct Answer

verified

True/False

An S shareholder's basis is increased by stock purchases and capital contributions.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The maximum number of shareholders in an S corporation is:

A) 75.

B) 100.

C) 200.

D) Indeterminable.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

Post-termination distributions by a former S corporation that are charged against ____________________ do not get tax-free treatment.

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 154

Related Exams