A) $500 dividend income.

B) $1,000 dividend income.

C) $1,500 dividend income.

D) $3,000 dividend income.

E) None of the above.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A limited liability company can own S corporation stock.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Passive investment income includes net capital gains from the sale of stocks and securities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The Schedule M-3 is the same for a C corporation and an S corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

An S corporation must own ____________________% of a subsidiary's stock in order to elect to treat the subsidiary as a QSSS.

Correct Answer

verified

Correct Answer

verified

True/False

The LIFO recapture tax is a variation of the passive investment income penalty tax.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Explain how the domestic production activities deduction is used for an S corporation.

Correct Answer

verified

The § 199 deduction is determined at the...View Answer

Show Answer

Correct Answer

verified

View Answer

True/False

A former spouse is treated as being in the same family as the individual to whom he or she was married.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An item that appears in the "Other Adjustments Account" affects stock basis,but not AAA,such as tax-exempt life insurance proceeds.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which item does not appear on Schedule K of Form 1120S?

A) Intangible drilling costs.

B) Foreign loss.

C) Recovery of a tax benefit.

D) Interest expense.

E) All of the above appear on Schedule K.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

An S corporation is limited to ____________________ (how many?)shareholders.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An S corporation with substantial AEP has operating revenues of $410,000,taxable interest income of $390,000,operating expenses of $260,000,and deductions attributable to the interest of $150,000.The passive income penalty tax payable,if any,is:

A) $0.

B) $40,923.

C) $116,923.

D) $136,500.

E) None of the above.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

An S shareholder's stock basis is reduced by flow-through losses before accounting for distributions.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

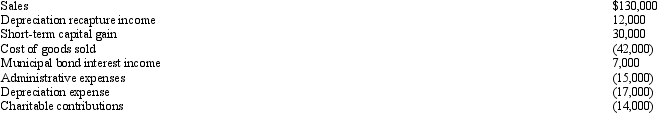

Bidden,Inc.,a calendar year S corporation,incurred the following items.

Calculate Bidden's nonseparately computed income.

Calculate Bidden's nonseparately computed income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is incorrect with respect to an S shareholder's consent?

A) An S election requires a consent from all of the S corporation's shareholders.

B) Both husband and wife must consent if one owns the stock as community property.

C) A consent extension is available only if Form 2553 is filed on a timely basis, reasonable cause is given, and the interests of the government are not jeopardized.

D) A consent must be in writing.

E) None of the above statements is incorrect.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Short Answer

S corporation status avoids the ____________________ taxation and ____________________ limitations inherent in the regular corporate form. or

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which is ineligible to be an S shareholder?

A) Individual.

B) Estate.

C) Partnership.

D) Spouse of a nonresident alien (common law state) .

E) None of the above.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 141 - 157 of 157

Related Exams