A) Stock B has a higher required rate of return than Stock A.

B) Portfolio P has a standard deviation of 22.5%.

C) More information is needed to determine the portfolio's beta.

D) Portfolio P has a beta of 1.0.

E) Stock A's returns are less highly correlated with the returns on most other stocks than are B's returns.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a stock's expected return as seen by the marginal investor exceeds this investor's required return, then the investor will buy the stock until its price has risen enough to bring the expected return down to equal the required return.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the price of money (e.g., interest rates and equity capital costs) increases due to an increase in anticipated inflation, the risk-free rate will also increase. If there is no change in investors' risk aversion, then the market risk premium (rM − rRF) will remain constant. Also, if there is no change in stocks' betas, then the required rate of return on each stock as measured by the CAPM will increase by the same amount as the increase in expected inflation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you randomly select stocks and add them to your portfolio, which of the following statements best describes what you should expect?

A) Adding more such stocks will increase the portfolio's expected rate of return.

B) Adding more such stocks will reduce the portfolio's beta coefficient and thus its systematic risk.

C) Adding more such stocks will have no effect on the portfolio's risk.

D) Adding more such stocks will reduce the portfolio's market risk but not its unsystematic risk.

E) Adding more such stocks will reduce the portfolio's unsystematic, or diversifiable, risk.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Diversifiable risk can be reduced by forming a large portfolio, but normally even highly-diversified portfolios are subject to market (or systematic) risk.

B) A large portfolio of randomly selected stocks will have a standard deviation of returns that is greater than the standard deviation of a 1-stock portfolio if that one stock has a beta less than 1.0.

C) A large portfolio of stocks whose betas are greater than 1.0 will have less market risk than a single stock with a beta = 0.8.

D) If you add enough randomly selected stocks to a portfolio, you can completely eliminate all of the market risk from the portfolio.

E) A large portfolio of randomly selected stocks will always have a standard deviation of returns that is less than the standard deviation of a portfolio with fewer stocks, regardless of how the stocks in the smaller portfolio are selected.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ivan Knobel holds a well-diversified portfolio that has an expected return of 11.0% and a beta of 1.20. He is in the process of buying 1,000 shares of Syngine Corp at $10 a share and adding it to his portfolio. Syngine has an expected return of 13.0% and a beta of 1.50. The total value of Ivan's current portfolio is $90,000. What will the expected return and beta on the portfolio be after the purchase of the Syngine stock?

A) 10.64%; 1.17

B) 11.20%; 1.23

C) 11.76%; 1.29

D) 12.35%; 1.36

E) 12.97%; 1.42

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The SML relates required returns to firms' systematic (or market) risk. The slope and intercept of this line can be influenced by a manager's actions.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are the factors for the Fama-French model?

A) The excess market return, a debt factor, and a book-to-market factor.

B) The excess market return, a size factor, and a debt.

C) A debt factor, a size factor, and a book-to-market factor.

D) The excess market return, an industrial production factor, and a book-to-market factor.

E) The excess market return, a size factor, and a book-to-market factor.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Two conditions are used to determine whether or not a stock is in equilibrium: (1) Does the stock's market price equal its intrinsic value as seen by the marginal investor, and (2) does the expected return on the stock as seen by the marginal investor equal this investor's required return? If either of these conditions, but not necessarily both, holds, then the stock is said to be in equilibrium.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

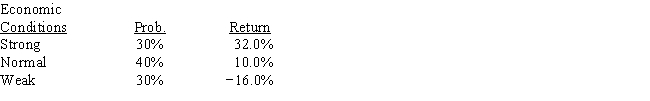

Stuart Company's manager believes that economic conditions during the next year will be strong, normal, or weak, and she thinks that the firm's returns will have the probability distribution shown below. What's the standard deviation of the estimated returns? (Hint: Use the formula for the standard deviation of a population, not a sample.)

A) 17.69%

B) 18.62%

C) 19.55%

D) 20.52%

E) 21.55%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Returns for the Alcoff Company over the last 3 years are shown below. What's the standard deviation of the firm's returns? (Hint: This is a sample, not a complete population, so the sample standard deviation formula should be used.)

A) 20.08%

B) 20.59%

C) 21.11%

D) 21.64%

E) 22.18%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For markets to be in equilibrium, that is, for there to be no strong pressure for prices to depart from their current levels,

A) The past realized rate of return must be equal to the expected future rate of return; that is, .![]()

B) The required rate of return must equal the past realized rate of return; that is, r = .![]()

C) The expected rate of return must be equal to the required rate of return; that is, = r.![]()

D) All of the above statements must hold for equilibrium to exist; that is = r = .![]()

![]()

E) None of the above statements is correct.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Portfolio AB was created by investing in a combination of Stocks A and B. Stock A has a beta of 1.2 and a standard deviation of 25%. Stock B has a beta of 1.4 and a standard deviation of 20%. Portfolio AB has a beta of 1.25 and a standard deviation of 18%. Which of the following statements is CORRECT?

A) Stock A has more market risk than Stock B but less stand-alone risk.

B) Portfolio AB has more money invested in Stock A than in Stock B.

C) Portfolio AB has the same amount of money invested in each of the two stocks.

D) Portfolio AB has more money invested in Stock B than in Stock A.

E) Stock A has more market risk than Portfolio AB.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock X has a beta of 0.7 and Stock Y has a beta of 1.7. Which of the following statements must be true, according to the CAPM?

A) Stock Y's realized return during the coming year will be higher than Stock X's return.

B) If the expected rate of inflation increases but the market risk premium is unchanged, the required returns on the two stocks should increase by the same amount.

C) Stock Y's return has a higher standard deviation than Stock X.

D) If the market risk premium declines, but the risk-free rate is unchanged, Stock X will have a larger decline in its required return than will Stock Y.

E) If you invest $50,000 in Stock X and $50,000 in Stock Y, your 2-stock portfolio would have a beta significantly lower than 1.0, provided the returns on the two stocks are not perfectly correlated.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Donald Gilmore has $100,000 invested in a 2-stock portfolio. $35,000 is invested in Stock X and the remainder is invested in Stock Y. X's beta is 1.50 and Y's beta is 0.70. What is the portfolio's beta?

A) 0.65

B) 0.72

C) 0.80

D) 0.89

E) 0.98

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stocks A and B each have an expected return of 15%, a standard deviation of 20%, and a beta of 1.2. The returns on the two stocks have a correlation coefficient of +0.6. Your portfolio consists of 50% A and 50% B. Which of the following statements is CORRECT?

A) The portfolio's expected return is 15%.

B) The portfolio's standard deviation is greater than 20%.

C) The portfolio's beta is greater than 1.2.

D) The portfolio's standard deviation is 20%.

E) The portfolio's beta is less than 1.2.

G) A) and B)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If an investor buys enough stocks, he or she can, through diversification, eliminate all of the diversifiable risk inherent in owning stocks. Therefore, if a portfolio contained all publicly traded stocks, it would be essentially riskless.

B) The required return on a firm's common stock is, in theory, determined solely by its market risk. If the market risk is known, and if that risk is expected to remain constant, then no other information is required to specify the firm's required return.

C) Portfolio diversification reduces the variability of returns (as measured by the standard deviation) of each individual stock held in a portfolio.

D) A security's beta measures its non-diversifiable, or market, risk relative to that of an average stock.

E) A stock's beta is less relevant as a measure of risk to an investor with a well-diversified portfolio than to an investor who holds only that one stock.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If you plotted the returns of a company against those of the market and found that the slope of your line was negative, the CAPM would indicate that the required rate of return on the stock should be less than the risk-free rate for a well-diversified investor, assuming that the observed relationship is expected to continue in the future.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Even if the correlation between the returns on two securities is +1.0, if the securities are combined in the correct proportions, the resulting 2-asset portfolio will have less risk than either security held alone.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Bloome Co.'s stock has a 25% chance of producing a 30% return, a 50% chance of producing a 12% return, and a 25% chance of producing a −18% return. What is the firm's expected rate of return?

A) 7.72%

B) 8.12%

C) 8.55%

D) 9.00%

E) 9.50%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 146

Related Exams