A) used to evaluate a company's liquidity and short-term debt paying ability

B) a solvency measure that indicates the margin of safety for bondholders

C) calculated by dividing current liabilities by current assets

D) calculated by subtracting current liabilities from current assets

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ability of a business to pay its debts as they come due and to earn a reasonable net income is

A) solvency and leverage

B) solvency and profitability

C) solvency and liquidity

D) solvency and equity

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the dividend yield for Diane Company?

A) 7.5%

B) 0.75%

C) 13.3%

D) 1.3%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

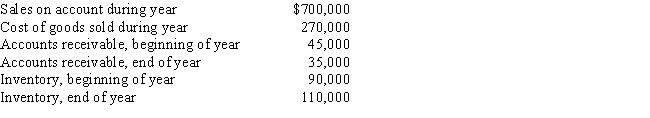

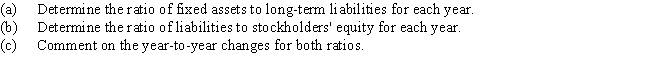

Based on the following data,what is the accounts receivable turnover?

A) 17.5

B) 2.6

C) 20.0

D) 15.5

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

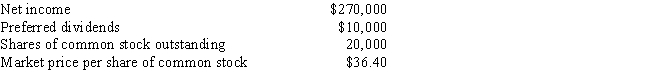

A company reported the following:

Calculate the company's price-earnings ratio.Round your answer to one decimal place.

Calculate the company's price-earnings ratio.Round your answer to one decimal place.

Correct Answer

verified

Price-earnings ratio = Market price per share of common stock / Earnings per share on common stock Earnings per share on common stock = (Net income - Preferred dividends) / Shares of common stock outstanding Earnings per share = ($270,000 - $10,000) / 20,000 Earnings per share = $13.00 Price-earnings ratio = $36.40 / $13.00 Price-earnings ratio = 2.8

Correct Answer

verified

Multiple Choice

Match each ratio that follows to its use (items a-h) .Items may be used more than once. -earnings per share (EPS) on common stock

A) assess the profitability of the assets

B) assess how effectively assets are used

C) indicate the ability to pay current liabilities

D) indicate how much of the company is financed by debt and equity

E) indicate instant debt-paying ability

F) assess the profitability of the investment by common stockholders

G) indicate future earnings prospects

H) indicate the extent to which earnings are being distributed to common stockholders

![]()

J) E) and F)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The purpose of an audit is to

A) determine whether or not a company is a good investment

B) render an opinion on the fairness of the statements

C) determine whether or not a company complies with corporate social responsibility

D) determine whether or not a company is a good credit risk

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A financial statement showing each item on the statement as a percentage of one key item on the statement is called a common-sized financial statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each ratio that follows to its use (items a-h) .Items may be used more than once. -return on total assets

A) assess the profitability of the assets

B) assess how effectively assets are used

C) indicate the ability to pay current liabilities

D) indicate how much of the company is financed by debt and equity

E) indicate instant debt-paying ability

F) assess the profitability of the investment by common stockholders

G) indicate future earnings prospects

H) indicate the extent to which earnings are being distributed to common stockholders

![]()

J) C) and E)

Correct Answer

verified

Correct Answer

verified

Essay

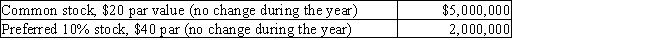

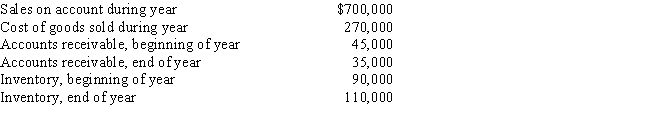

The following information was taken from the financial statement of Fox Resources for December 31 of the current fiscal year:

The net income was $600,000,and the declared dividends on the common stock were $125,000 for the current year.The market price of the common stock is $20 per share.

Calculate for the common stock:

(a)earnings per share

(b)the price-earnings ratio

(c)the dividends per share and the dividend yield

Round to one decimal place except earnings per share,which should be rounded to two decimal places.

The net income was $600,000,and the declared dividends on the common stock were $125,000 for the current year.The market price of the common stock is $20 per share.

Calculate for the common stock:

(a)earnings per share

(b)the price-earnings ratio

(c)the dividends per share and the dividend yield

Round to one decimal place except earnings per share,which should be rounded to two decimal places.

Correct Answer

verified

11ea8952_b5fd_bd8b_861b_7ba182fdeb1a_TB6238_00

Correct Answer

verified

Multiple Choice

Match each ratio that follows to its use (items a-h) .Items may be used more than once. -asset turnover ratio

A) assess the profitability of the assets

B) assess how effectively assets are used

C) indicate the ability to pay current liabilities

D) indicate how much of the company is financed by debt and equity

E) indicate instant debt-paying ability

F) assess the profitability of the investment by common stockholders

G) indicate future earnings prospects

H) indicate the extent to which earnings are being distributed to common stockholders

![]()

J) E) and G)

Correct Answer

verified

Correct Answer

verified

Essay

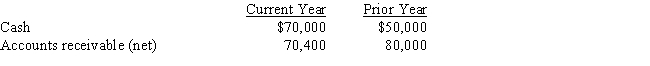

Cash and accounts receivable for Adams Company are provided below:

What is the amount and percentage of increase or decrease that would be shown with horizontal analysis?

What is the amount and percentage of increase or decrease that would be shown with horizontal analysis?

Correct Answer

verified

Correct Answer

verified

Essay

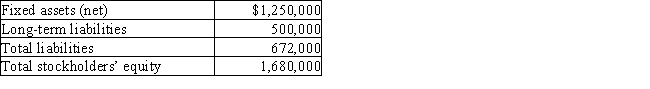

The following information was taken from Slater Company's balance sheet:

Determine the company's (a)ratio of fixed assets to long-term liabilities,and (b)ratio of liabilities to stockholders' equity.Round your answer to one decimal place.

Determine the company's (a)ratio of fixed assets to long-term liabilities,and (b)ratio of liabilities to stockholders' equity.Round your answer to one decimal place.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on the data for Harding Company,what is the amount of working capital?

A) $238,000

B) $128,000

C) $168,000

D) $203,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Percentage analyses,ratios,turnovers,and other measures of financial position and operating results are

A) a substitute for sound judgment

B) useful analytical measures

C) enough information for analysis; industry information is not needed

D) unnecessary for analysis if industry information is available

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The percent of fixed assets to total assets is an example of

A) vertical analysis

B) solvency analysis

C) profitability analysis

D) horizontal analysis

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

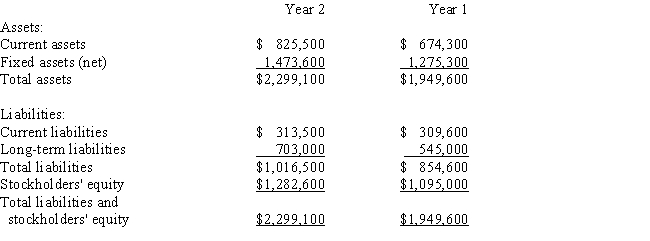

The following information has been condensed from the December 31 balance sheets of Gabriel Co.:

Round your answers to two decimal places.

Round your answers to two decimal places.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on the following data for the current year,what is the inventory turnover?

A) 2.7

B) 9.7

C) 2.5

D) 3.0

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A decrease in the ratio of liabilities to stockholders' equity indicates an improvement in the margin of safety for creditors.

B) False

Correct Answer

verified

True

Correct Answer

verified

Essay

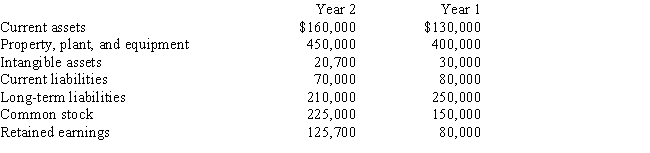

Condensed data taken from the ledger of St.Louis Company at December 31,for the current and preceding years,are as follows:

Prepare a comparative balance sheet,with horizontal analysis,for December 31,Year 2 and Year 1.(Round percents to one decimal point.)

Prepare a comparative balance sheet,with horizontal analysis,for December 31,Year 2 and Year 1.(Round percents to one decimal point.)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 189

Related Exams