Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to a summary of the payroll of Scotland Company,$450,000 was subject to the 6.0% social security tax and $500,000 was subject to the 1.5% Medicare tax.Federal income tax withheld was $98,000.Also,$15,000 was subject to state (4.2%) and federal (0) 8%) unemployment taxes.The journal entry to record the accrued payroll taxes would include a

A) debit to SUTA Payable for $630

B) debit to SUTA Payable for $18,900

C) credit to SUTA Payable for $630

D) credit to SUTA Payable for $18,900

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming a 360-day year,when a $20,000,90-day,5% interest-bearing note payable matures,total payment will be

A) $21,000

B) $1,000

C) $20,250

D) $250

F) A) and D)

Correct Answer

verified

Correct Answer

verified

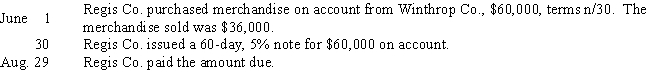

Essay

Journalize the following entries on the books of the borrower and creditor.Label accordingly.

(Assume a 360-day year is used for interest calculations.)

Correct Answer

verified

Correct Answer

verified

True/False

Depending on when an unfunded pension liability is to be paid,it will be classified on the balance sheet as either a long-term or a current liability.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A pension plan that promises employees a fixed annual pension benefit,based on years of service and compensation,is called a (n)

A) defined contribution plan

B) defined benefit plan

C) unfunded plan

D) compensation plan

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Blast sells portable CD players,and each unit carries a one-year replacement warranty.The cost of repair defects under the warranty is estimated at 10% of the sales price.During May,Blast sells 650 portable CD players for $50 each.For what amount in May would Blast debit Product Warranty Expense?

A) $3,250

B) $1,625

C) $650

D) $1,300

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

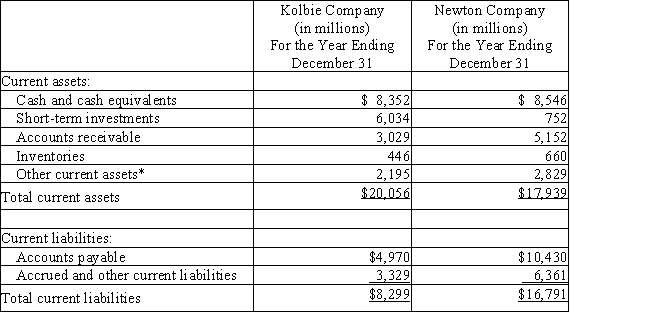

The current assets and current liabilities for Kolbie Company and Newton Company are as follows:  *These represent prepaid expenses and other non-quick current assets.

(a) Determine the quick ratio for both companies.Round to two decimal places.

(b) Interpret the quick ratio difference between the two companies.

*These represent prepaid expenses and other non-quick current assets.

(a) Determine the quick ratio for both companies.Round to two decimal places.

(b) Interpret the quick ratio difference between the two companies.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of a variable component of a payroll system?

A) hours worked

B) Medicare tax rate

C) rate of pay

D) social security number

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

One of the more popular defined contribution plans is the 401k plan.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company uses to record accrued vacation privileges for its employees at the end of the year is

A) debit Vacation Pay Expense; credit Vacation Pay Payable

B) debit Vacation Pay Payable; credit Vacation Pay Expense

C) debit Salaries Expense; credit Cash

D) debit Salaries Expense; credit Salaries Payable

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Payroll taxes levied against employees become liabilities

A) the first of the following month

B) when the payroll is paid to employees

C) when data are entered in a payroll register

D) at the end of an accounting period

F) B) and C)

Correct Answer

verified

Correct Answer

verified

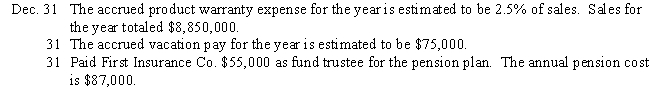

Essay

Journalize the following transactions for Riley Corporation:

Correct Answer

verified

Correct Answer

verified

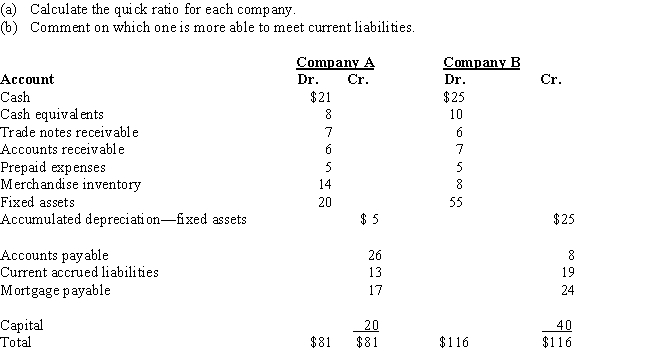

Essay

For Company A and Company B:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

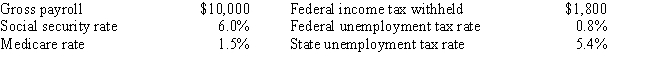

Use this information for Harris Company to answer the following questions.

Assuming no employees are subject to ceilings for their earnings, Harris Company has the following information for the pay period of January 15-31.

-Assume that social security taxes are payable at a 6.0% rate,Medicare taxes are payable at a 1.5% rate with no maximum earnings,and federal and state unemployment compensation taxes total 4.6% on the first $7,000 of earnings.If an employee earns $2,500 for the current week and the employee's year-to-date earnings before this week were $6,800,what is the total payroll tax related to the current week?

-Assume that social security taxes are payable at a 6.0% rate,Medicare taxes are payable at a 1.5% rate with no maximum earnings,and federal and state unemployment compensation taxes total 4.6% on the first $7,000 of earnings.If an employee earns $2,500 for the current week and the employee's year-to-date earnings before this week were $6,800,what is the total payroll tax related to the current week?

A) $187.50

B) $196.70

C) $344.50

D) $9.20

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following taxes would be deducted in determining an employee's net pay?

A) FUTA taxes

B) SUTA taxes

C) FICA taxes

D) All of these choices

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

FICA tax becomes a liability to the federal government at the time an employee's payroll is prepared.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Form W-2 is called the Wage and Tax Statement.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Federal income taxes withheld increase the employer's payroll tax expense.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scott Company sells merchandise with a one-year warranty.Sales consisted of 2,500 units in Year 1 and 2,000 units in Year 2.It is estimated that warranty repairs will average $10 per unit sold,and 30% of the repairs will be made in Year 1 and 70% in Year 2 for the Year 1 sales.Similarly,30% of repairs will be made in Year 2 and 70% in Year 3 for the Year 2 sales.In the Year 3 income statement,how much of the warranty expense shown will be due to Year 1 sales?

A) $6,000

B) $14,000

C) $20,000

D) $0

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 197

Related Exams