A) a gain on the sale of land

B) a decrease in accounts payable

C) an increase in accrued liabilities

D) dividends paid on common stock

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following should be added to net income in calculating net cash flow from operating activities using the indirect method?

A) depreciation expense

B) an increase in inventory

C) a gain on the sale of equipment

D) dividends declared and paid

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

To determine cash payments for income tax for the cash flow statement using the direct method, an increase in income taxes payable is added to the income tax expense.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a business issued bonds payable in exchange for land, the transaction would be reported in a separate schedule on the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the statement of cash flows, the cash flows from investing activities section would include

A) receipts from the issuance of capital stock

B) payments for dividends

C) payments for retirement of bonds payable

D) receipts from the sale of investments

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

To determine cash payments for operating expenses for the cash flow statement using the direct method, a decrease in prepaid expenses is added to operating expenses other than depreciation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accounts receivable resulting from sales to customers amounted to $40,000 and $31,000 at the beginning and end of the year, respectively. Income reported on the income statement for the year was $120,000. Exclusive of the effect of other adjustments, the cash flows from operating activities to be reported on the statement of cash flows is

A) $120,000.

B) $129,000.

C) $151,000.

D) $111,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following below increases cash?

A) depreciation expense

B) acquisition of treasury stock

C) borrowing money by issuing a six-month note

D) the declaration of a cash dividend

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Net income for the year was $29,500. Accounts receivable increased $2,500, and accounts payable increased $5,400. Under the indirect method, the cash flow from operations is $32,400.

B) False

Correct Answer

verified

Correct Answer

verified

Matching

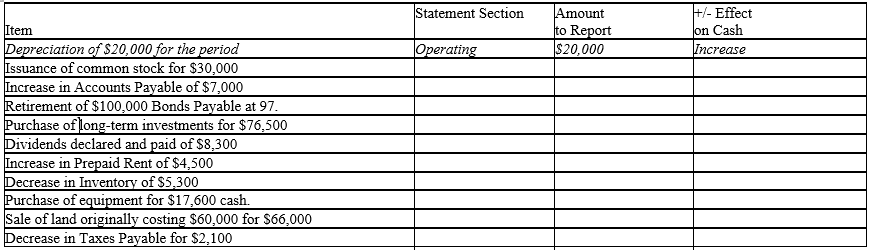

Identify which section the statement of cash flows (using the indirect method) would present information regarding the following activities: (operating, investing, financing):

Correct Answer

Multiple Choice

Depreciation on factory equipment would be reported in the statement of cash flows prepared by the indirect method in

A) the cash flows from financing activities section

B) the cash flows from investing activities section

C) a separate schedule

D) the cash flows from operating activities section

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

There is no difference in the Investing and Financing sections of the statement of cash flows using the indirect and direct method.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following types of transactions would be reported as a cash flow from investing activity on the statement of cash flows?

A) issuance of bonds payable

B) issuance of capital stock

C) purchase of treasury stock

D) purchase of noncurrent assets

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Complete each of the columns on the table below, indicating in which section each item would be reported on the statement of cash flow (Operating, Investing, or Financing), the amount that would be reported, and whether the item would create an increase or decrease in cash. For item that affect more than one section of the statement, indicate all affected. Assume the indirect method of reporting cash flows operating activities.

The first item has been completed as an example.

Correct Answer

verified

Correct Answer

verified

True/False

In determining the cash flows from operating activities for the statement of cash flows by the indirect method, the depreciation expense for the period is added to the net income for the period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Investing activities include

A) collecting cash on loans made.

B) obtaining cash from customers.

C) obtaining capital from stockholders.

D) repaying money previously borrowed.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Cash flows from investing activities, as part of the statement of cash flows, include payments for the purchase of treasury stock.

B) False

Correct Answer

verified

Correct Answer

verified

Matching

For each of the following, identify whether it would be disclosed as an operating , financing, or investing activity on the statement of cash flows under the indirect method.

Correct Answer

True/False

If 800 shares of $40 par common stock are sold for $43,000, the $43,000 would be reported in the cash flows from financing activities section of the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following should be shown on a statement of cash flows under the financing activity section?

A) the purchase of a long-term investment in the common stock of another company

B) the payment of cash to retire a long-term note

C) the proceeds from the sale of a building

D) the issuance of a long-term note to acquire land

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 161

Related Exams