B) False

Correct Answer

verified

Correct Answer

verified

Essay

While Susan was on vacation during the current year, someone broke into her home and stole the following items: ? A computer used 60% in connection with Susan's employment as an employee and 40% for her personal use. The cost of the computer was $8,000. Depreciation of $3,000 had been taken on the computer and it had a fair market value of $4,000 at the time of the theft. ? A painting, which Susan purchased as an investment for $10,000, had a fair market value of $17,000. ? Silverware purchased for $3,000 had a fair market value of $5,000. ? Cash of $30,000. Susan's adjusted gross income, before considering any of the above items, is $60,000. Determine the total amount of Susan's itemized deductions resulting from the theft.

Correct Answer

verified

Correct Answer

verified

Essay

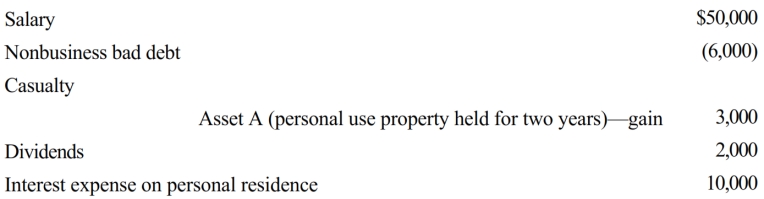

Mike, single, age 31, had the following items for 2018:

Compute Mike's taxable income for 2018.

Compute Mike's taxable income for 2018.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

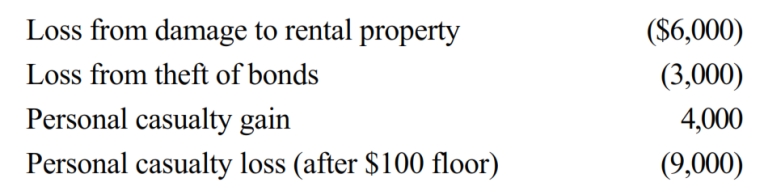

In 2018, Morley, a single taxpayer, had an AGI of $30,000 before considering the following items:  The personal casualties occurred in a Federally-declared disaster area. Determine the amount of Morley's itemized deduction from the losses.

The personal casualties occurred in a Federally-declared disaster area. Determine the amount of Morley's itemized deduction from the losses.

A) $0

B) $2,900

C) $5,120

D) $5,600

E) None of the above

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The amount of a business loss cannot exceed the amount of the taxpayer's NOL for the taxable year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Peggy is in the business of factoring accounts receivable. Last year, she purchased a $30,000 account receivable for $25,000. This year, the account was settled for $25,000. How much loss can Peggy deduct and in which year?

A) $5,000 for the current year.

B) $5,000 for the prior year and $5,000 for the current year.

C) $5,000 for the prior year.

D) $10,000 for the current year.

E) None of the above.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year, Lucy purchased a $100,000 account receivable for $90,000. During the current year, Lucy collected $97,000 on the account. What are the tax consequences to Lucy associated with the collection of the account receivable? No subsequent collections are expected.

A) $0

B) $2,000 gain

C) $3,000 loss

D) $13,000 loss

E) None of the above

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A taxpayer can carry an NOL forward indefinitely.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In 2017, Amos had AGI of $50,000. Amos also had a diamond ring stolen which cost $20,000 and was worth $17,000 at the time of the theft. He itemized deductions on last year's tax return. In 2018, Amos recovered $17,000 from the insurance company. Therefore, he must include $11,900 in gross income on the tax return for the current year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A business bad debt is a debt unrelated to the taxpayer's trade or business either when it was created or when it became worthless.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Alicia was involved in an automobile accident in 2018. Her car was used 60% for business and 40% for personal use. The car had originally cost $40,000. At the time of the accident, the car was worth $20,000 and Alicia had taken $8,000 of depreciation. The car was totally destroyed and Alicia had let her car insurance expire. If Alicia's AGI is $50,000 (before considering the loss) , determine her AGI and itemized deduction for the casualty loss.

A) $34,000? $-0-.

B) $50,000? $-0-.

C) $34,000? $4,500.

D) $26,000? $5,700.

E) None of the above

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The amount of partial worthlessness on a nonbusiness bad debt is deducted in the year partial worthlessness is determined.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The purpose of the "excess business loss" rules are to limit the amount of non-business income (e.g., salaries, interest, dividends, etc.) that can be "sheltered" from tax as a result of business losses.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Susan has the following items for 2018: ? Loss on rental property caused by termites-$110,000. Insurance covered 80% of the loss. ? Loss on personal use automobile-$10,000. The insurance policy does not cover the first $3,000 of loss. Susan decided not to file a claim for the loss. ? Loss on a painting stolen from Susan's house. Susan purchased the painting three years ago as an investment. She paid $40,000 for the painting and it was worth $35,000 at the time of the theft. The painting was insured for the fair market value. ? Salary-$40,000. Determine Susan's AGI and total amount of itemized deductions for 2018.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 94 of 94

Related Exams