B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) In managing a firm's accounts receivable, it is possible to increase credit sales per day yet still keep accounts receivable fairly steady, provided the firm can shorten the length of its collection period (its DSO) sufficiently.

B) Because of the costs of granting credit, it is not possible for credit sales to be more profitable than cash sales.

C) Since receivables and payables both result from sales transactions, a firm with a high receivables-to-sales ratio must also have a high payables-to-sales ratio.

D) Other things held constant, if a firm can shorten its DSO, this will lead to a higher current ratio.

E) A firm that makes 90% of its sales on credit and 10% for cash is growing at a constant rate of 10% annually.Such a firm will be able to keep its accounts receivable at the current level, since the 10% cash sales can be used to finance the 10% growth rate.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sanders Enterprises arranged a revolving credit agreement of $9, 000, 000 with a group of banks.The firm paid an annual commitment fee of 0.5% of the unused balance of the loan commitment.On the used portion of the revolver, it paid 1.5% above prime for the funds actually borrowed on a simple interest basis.The prime rate was 3.25% during the year.If the firm borrowed $6, 000, 000 immediately after the agreement was signed and repaid the loan at the end of one year, what was the total dollar annual cost of the revolver?

A) $285, 000

B) $300, 000

C) $315, 000

D) $330, 750

E) $347, 288

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

An increase in any current asset must be accompanied by an equal increase in some current liability.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

One of the effects of ceasing to take trade credit discounts is that the firm's accounts payable will rise, other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The calculated cost of trade credit can be reduced by paying late.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

On average, a firm collects checks totaling $250, 000 per day.It takes the firm approximately 4 days from the day the checks were mailed until they result in usable cash for the firm.Assume that (1)a lockbox system could be employed which would reduce the cash conversion procedure to 2 1/2 days and (2)the firm could invest any additional cash generated at 6% after taxes.The lockbox system would be a good buy if it costs $25, 000 annually.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

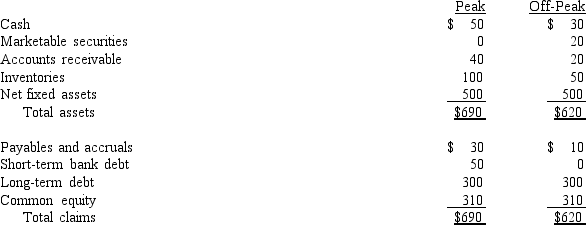

Summary balance sheet data for Greener Gardens Co.is shown below (in thousands of dollars) .The company is in a highly seasonal business, and the data show its assets and liabilities at peak and off-peak seasons:

From this data we may conclude that

From this data we may conclude that

A) Greener Gardens' current asset financing policy is relatively aggressive; that is, the company finances some of its permanent assets with short-term discretionary debt.

B) Greener Gardens follows a relatively conservative approach to current asset financing; that is, some of its short-term needs are met by permanent capital.

C) Without income statement data, we cannot determine the aggressiveness or conservatism of the company's current asset financing policy.

D) Without cash flow data, we cannot determine the aggressiveness or conservatism of the company's current asset financing policy.

E) Greener Gardens' current asset financing policy calls for exactly matching asset and liability maturities.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

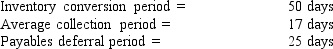

Frosty Corporation has the following data, in thousands.Assuming a 365-day year, what is the firm's cash conversion cycle?

A) 25 days

B) 28 days

C) 31 days

D) 35 days

E) 38 days

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If one of your firm's customers is "stretching" its accounts payable, this may be a nuisance but it does not represent a real financial cost to your firm as long as the customer periodically pays off its entire balance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

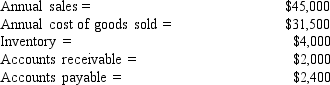

Marshall Inc.recently hired your consulting firm to improve the company's performance.It has been highly profitable but has been experiencing cash shortages due to its high growth rate.As one part of your analysis, you want to determine the firm's cash conversion cycle.Using the following information and a 365-day year, what is the firm's present cash conversion cycle?

A) 120.6 days

B) 126.9 days

C) 133.6 days

D) 140.6 days

E) 148.0 days

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Conservative firms generally use no short-term debt and thus have zero current liabilities.

B) A short-term loan can usually be obtained more quickly than a long-term loan, but the cost of short-term debt is normally higher than that of long-term debt.

C) If a firm that can borrow from its bank at a 6% interest rate buys materials on terms of 2/10 net 30, and if it must pay by Day 30 or else be cut off, then we would expect to see zero accounts payable on its balance sheet.

D) If one of your firm's customers is "stretching" its accounts payable, this may be a nuisance but it will not have an adverse financial impact on your firm if the customer periodically pays off its entire balance.

E) Under normal conditions, a firm's expected ROE would probably be higher if it financed with short-term rather than with long-term debt, but using short-term debt would probably increase the firm's risk.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If the yield curve is upward sloping, then short-term debt will be cheaper than long-term debt.Thus, if a firm's CFO expects the yield curve to continue to have an upward slope, this would tend to cause the current ratio to be relatively low, other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

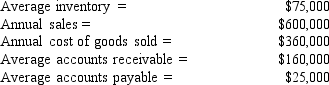

Brothers Breads has the following data.What is the firm's cash conversion cycle?

A) 31 days

B) 34 days

C) 38 days

D) 42 days

E) 46 days

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Monar Inc.'s CFO would like to decrease its cash conversion cycle by 10 days (based on a 365 day year) .The company carries average inventory of $750, 000.Its annual sales are $10 million, its cost of goods sold is 75% of annual sales, and its average collection period is twice as long as its inventory conversion period.The firm buys on terms of net 30 days, and it pays on time.The CFO believes he can reduce the average inventory to $647, 260 with no effect on sales.By how much must the firm also reduce its accounts receivable to meet its goal in the reduction of the cash conversion cycle?

A) $123, 630

B) $130, 137

C) $136, 986

D) $143, 836

E) $151, 027

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Uncertainty about the exact lives of assets prevents precise maturity matching in an ex post (i.e., after the fact)sense even though it is possible to match maturities on an ex ante (expected)basis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Safety Window and Door Co.buys on terms of 2/15, net 60 days.It does not take discounts, and it typically pays on time, 60 days after the invoice date.Net purchases amount to $450, 000 per year.On average, how much "free" trade credit does the firm receive during the year? (Assume a 365-day year, and note that purchases are net of discounts.)

A) $18, 493

B) $19, 418

C) $20, 389

D) $21, 408

E) $22, 479

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

For a zero-growth firm, it is possible to increase the percentage of sales that are made on credit and still keep accounts receivable at their current level, provided the firm can shorten the length of its collection period sufficiently.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Whitson Co.is looking for ways to shorten its cash conversion cycle.It has annual sales of $36, 500, 000, or $100, 000 a day on a 365-day basis.The firm's cost of goods sold is 75% of sales.On average, the company has $9, 000, 000 in inventory and $8, 000, 000 in accounts receivable.Its CFO has proposed new policies that would result in a 20% reduction in both average inventories and accounts receivable.She also anticipates that these policies would reduce sales by 10%, while the payables deferral period would remain unchanged at 35 days.What effect would these policies have on the company's cash conversion cycle? Round to the nearest whole day.

A) -26 days

B) -22 days

C) -18 days

D) -14 days

E) -11 days

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Howes Inc.purchases $4, 562, 500 in goods per year from its sole supplier on terms of 2/15, net 50.If the firm chooses to pay on time but does not take the discount, what is the effective annual percentage cost of its non-free trade credit? (Assume a 365-day year.)

A) 20.11%

B) 21.17%

C) 22.28%

D) 23.45%

E) 24.63%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 138

Related Exams