A) Sales

B) Accounts Receivable

C) Merchandise Inventory

D) Accounts Payable

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When goods are shipped FOB destination and the seller pays the freight charges, the buyer

A) journalizes a reduction for the cost of the merchandise.

B) journalizes a reimbursement to the seller.

C) does not take a discount.

D) makes no journal entry for the freight.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

On March 29th, customers who owe $10,500.00 for purchases made on Sonic Sales Company submit payments of $4,250.00. Journalize this event.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the perpetual inventory system is used, the inventory sold is shown on the income statement as

A) cost of merchandise sold

B) purchases

C) purchases returns and allowances

D) net purchases

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Discounts taken by a buyer because of early payment are recorded on the seller's accounting records as

A) Purchases discount

B) Sales discount

C) Trade discount

D) Early payment discount

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company, using the periodic inventory system, has merchandise inventory costing $175 on hand at the beginning of the period. During the period, merchandise costing $635 is purchased. At year-end, merchandise inventory costing $160 is on hand. The cost of merchandise sold for the year is

A) $970

B) $650

C) $300

D) $620

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Retailers record all credit card sales as credit sales.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Service businesses provide services for income, while a merchandising business sells merchandise.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Sales Returns and Allowances is a contra-revenue account.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts has a normal debit balance?

A) Accounts Payable

B) Sales Returns and Allowances

C) Sales

D) Interest Revenue

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Freight-in is considered a cost of purchasing inventory.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the periodic inventory system, the journal entry to record the cost of merchandise sold at the point of sale will include the following account

A) No entry is made.

B) Cost of merchandise sold

C) Inventory

D) Purchases

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

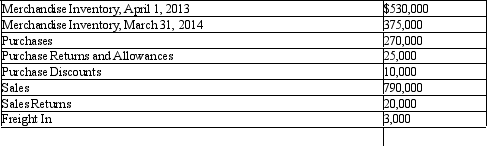

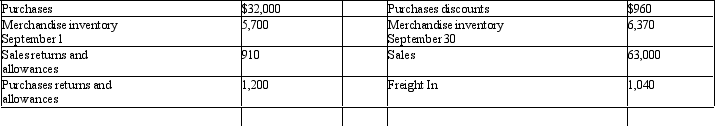

The following data were extracted from the accounting records of Meridian Designs for the year ended March 31, 2014.

Prepare the cost of merchandise sold section of the income statement for the year ended March 31, 2014, using the periodic method. Also determine gross profit.

Prepare the cost of merchandise sold section of the income statement for the year ended March 31, 2014, using the periodic method. Also determine gross profit.

Correct Answer

verified

Correct Answer

verified

True/False

In a perpetual inventory system, when merchandise is returned to the seller, Cost of Merchandise Sold is debited as part of the transaction.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

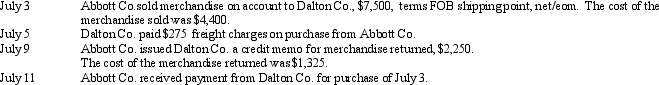

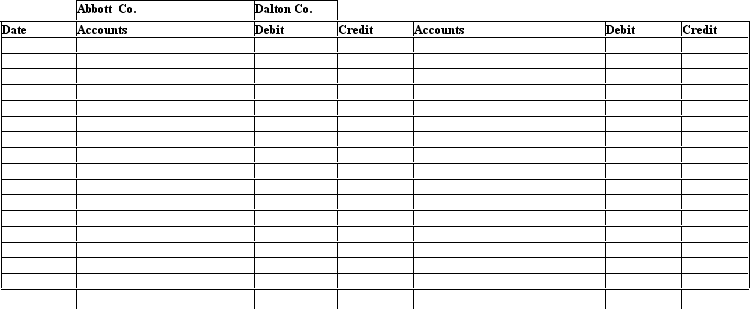

Journalize the following transactions for both Abbott Co. (seller) and Dalton Co. (buyer). Assume both the companies use the perpetual inventory system.

Correct Answer

verified

Correct Answer

verified

True/False

A sale of $750 on account, subject to a sales tax of 6%, would be recorded as an account receivable of $750.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

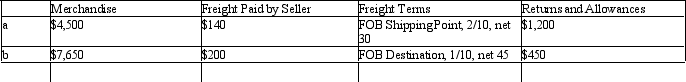

Determine the amount to be paid in full settlement of each invoice, assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period.

a

a

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the following information, what is the amount of net sales?

A) $28,970

B) $63,130

C) $63,000

D) $62,090

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When the seller offers a sales discount, even if borrowing has to be done, it is generally advantageous for the buyer to pay within the discount period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A chart of accounts for a merchandising business

A) usually is the same as the chart of accounts for a service business

B) usually requires more accounts than does the chart of accounts for a service business

C) usually is standardized by the FASB for all merchandising businesses

D) always uses a three-digit numbering system

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 215

Related Exams